You’re drowning in debt. Credit cards, medical bills, personal loans – they’re crushing you. You can’t sleep. You can’t breathe. You feel like a failure, but you’re not.

You’re someone who got hit by life – job loss, medical emergency, divorce, business failure. It happens to good people every day. Chapter 7 bankruptcy isn’t giving up – it’s fighting back.

At Gort Law, we’ve helped over 1,000 Jupiter residents eliminate their debt through Chapter 7 bankruptcy. In just 3-4 months, you can be completely debt-free and ready to rebuild your life.

Stop the pain. Start your fresh start. Call (561) 900-0478 for your free bankruptcy consultation.

Chapter 7 is the fastest way to eliminate debt legally. In about 90 days, most of your debts disappear forever. No more payments. No more interest. No more collection calls. You keep your home, car, retirement accounts, and most personal property.

It’s not the end of your story – it’s a new chapter.

Debts eliminated in Chapter 7:

– Credit card debt (all of it)

– Medical bills

– Personal loans

– Payday loans

– Deficiency balances from repossessions

– Old utility bills

– Most lawsuit judgments

Income Requirements

Chapter 7 has income limits, but most working families qualify. If you make less than the median income in Florida, you automatically qualify. If you make more, we can often still qualify you using allowable expenses.

Asset Protection

You keep most of your property in Chapter 7:

– Your home (up to $175,000 in equity in Florida)

– Your car (reasonable value)

– All retirement accounts (401k, IRA, pensions)

– Most household goods and clothing

– Tools of your trade

– Life insurance

The Means Test

This determines if you qualify based on income and expenses. It sounds scary, but we handle all the calculations and paperwork. Most people who think they don’t qualify actually do.

Step 1: Stop All Payments Immediately

Once we file, you stop paying credit cards, medical bills, and most other debts. The money you were throwing away on minimum payments stays in your pocket.

Step 2: Automatic Stay Protection

All collection calls, lawsuits, and garnishments stop immediately. Debt collectors must leave you alone – it’s federal law.

Step 3: Meeting of Creditors

A simple 5-10 minute meeting where the trustee asks basic questions about your paperwork. We prepare you completely, and we’re with you the entire time.

Step 4: Discharge and Freedom

About 60 days later, you receive your discharge order. Your debts are gone forever. You’re free to rebuild your financial life.

We’ve Filed Over 1,000 Successful Cases

Experience matters in bankruptcy court. We know every trustee, every procedure, and every trick to protect your assets and get you qualified.

We Maximize Your Asset Protection

Florida has some of the best bankruptcy exemptions in the country. We make sure you keep everything legally possible.

Same-Day Filing When Needed

Facing foreclosure, garnishment, or repo? We can often file your case the same day to stop it immediately.

Fixed Fee, Payment Plans Available

No surprises. We quote a flat fee upfront and offer payment plans so you can afford quality representation.

Myth: “Bankruptcy ruins your credit forever”

Reality: Most clients rebuild their credit within 1-2 years and get better loan terms than they had before filing.

Myth: “You lose everything in Chapter 7”

Reality: Over 95% of our clients keep their home, car, and all personal belongings.

Myth: “Only deadbeats file bankruptcy”

Reality: Bankruptcy clients include teachers, nurses, business owners, and retirees – good people hit by bad circumstances.

Myth: “You can’t get credit after bankruptcy”

Reality: Credit card offers start arriving within months of discharge, often with better terms than you had before.

Myth: “Bankruptcy is shameful”

Reality: It’s a legal right designed to give honest people a fresh start. Even millionaires and corporations use bankruptcy strategically.

Some debts survive Chapter 7:

– Recent taxes (usually 3 years or newer)

– Student loans (in most cases)

– Child support and alimony

– Recent credit card luxury purchases

– Drunk driving judgments

– HOA fees accruing after filing

We review all your debts to show exactly what will be eliminated and what will remain.

Every month you delay Chapter 7 costs you money:

– Thousands in minimum payments that will never reduce your debt

– Interest and fees that keep growing

– Garnishments taking money from every paycheck

– Stress-related health problems

– Family relationships destroyed by financial pressure

The average client saves their attorney fee in the first month after filing. Call (561) 900-0478 today.

Your Free Bankruptcy Consultation Includes

✓ Complete analysis of your debts and income

✓ Chapter 7 qualification assessment

✓ Asset protection planning

✓ Timeline and cost breakdown

✓ Immediate steps to stop collections

✓ Honest answers to all your questions

No judgment, no pressure – just solutions

How long does Chapter 7 take?

Most cases are complete in 3-4 months from filing to discharge. You can start rebuilding immediately.

Will my employer find out?

Probably not. While bankruptcy is public record, most employers never check and have no reason to look.

Can I file Chapter 7 more than once?

Yes, but you must wait 8 years between Chapter 7 discharges. Chapter 13 can be filed 4 years after Chapter 7.

What happens to my credit score?

It initially drops, but most clients see improvement within 12-18 months as negative accounts are removed and debt-to-income ratio improves dramatically.

Can creditors object to my bankruptcy?

Rarely, and usually only if there’s fraud or recent luxury purchases. We review your case to prevent any complications.

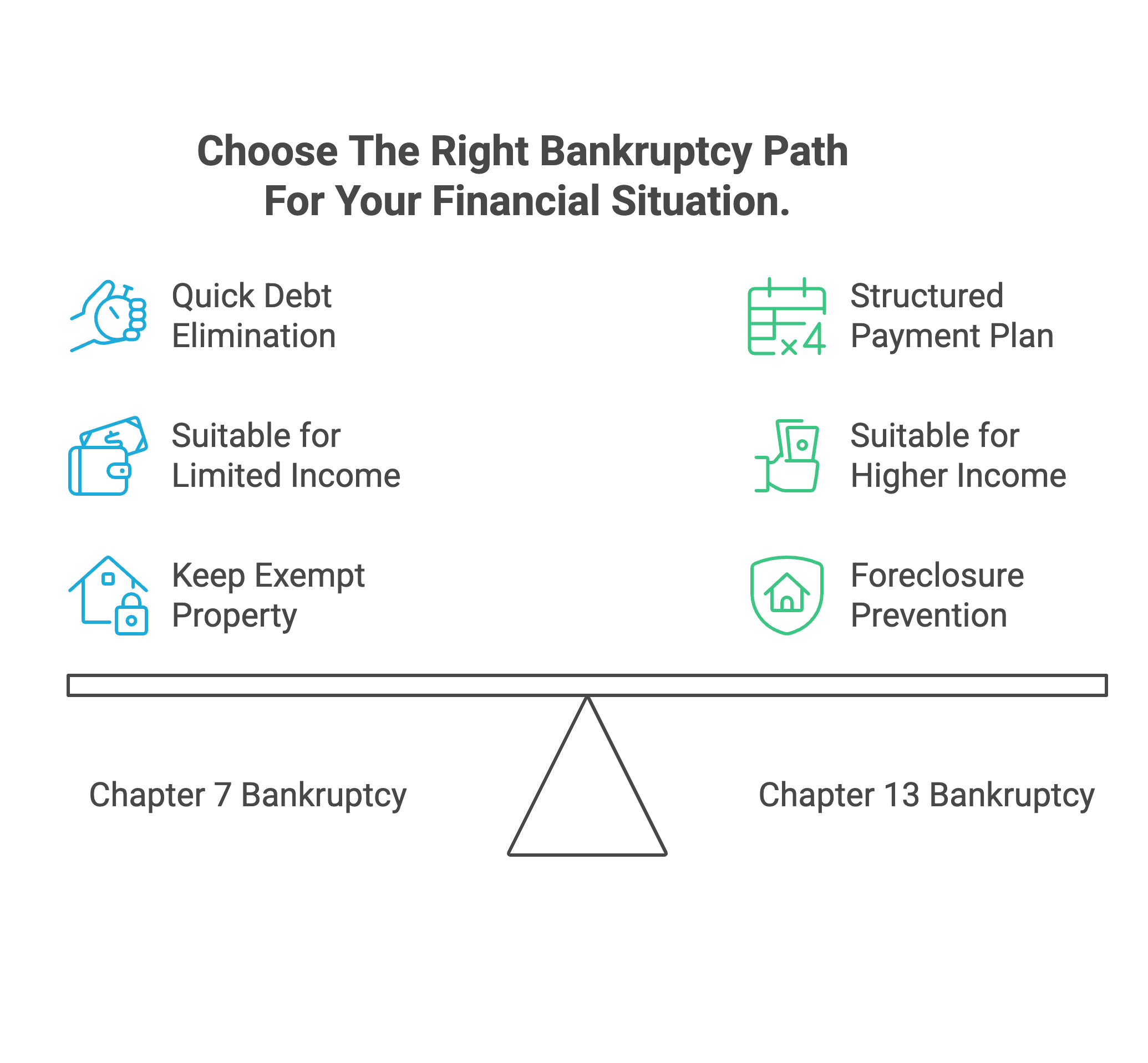

Chapter 7: Fresh Start Bankruptcy

– Debts eliminated in 3-4 months

– No payment plan required

– Keep exempt property

– Best for people with limited income

Chapter 13: Reorganization

– 3-5 year payment plan

– Can stop foreclosure and catch up mortgages

– Better for higher income earners

– Can force reduced payments on some debts

We help you choose the right chapter for your situation.

We help families file Chapter 7 bankruptcy throughout South Florida, including Jupiter, Palm Beach Gardens, West Palm Beach, Wellington, Boynton Beach, Delray Beach, and all surrounding areas.

Gort Law Office

123 Main Street

Jupiter, FL 33458

Chapter 7 Bankruptcy Hotline: (561) 900-0478

You Deserve a Fresh Start

Debt doesn’t define you. Your past mistakes don’t determine your future. Chapter 7 bankruptcy is your legal right to start over when life knocks you down.

Millions of Americans have used Chapter 7 to rebuild their lives. Successful business owners, happy families, thriving individuals – all bankruptcy survivors who chose to fight back instead of give up.

Your fresh start is one phone call away.

Call Gort Law: (561) 900-0478

Jupiter’s Chapter 7 bankruptcy attorney – helping good people get the fresh start they deserve.

If you are considering filing for bankruptcy or need an attorney to represent you in a civil, real estate, business, or construction deficit lawsuit in the Jupiter, Florida area, contact us at Gort Law P.A..

Mon

09:00 AM – 05:00 PM

Tue

09:00 AM – 05:00 PM

Wed

09:00 AM – 05:00 PM

Thur

09:00 AM – 05:00 PM

Fri

09:00 AM – 05:00 PM

Closed from 12PM – 1PM

BUSINESS HOURS

Mon

09:00 AM – 05:00 PM

Tue

09:00 AM – 05:00 PM

Wed

09:00 AM – 05:00 PM

Thur

09:00 AM – 05:00 PM

Fri

09:00 AM – 05:00 PM

Closed from 12PM – 1PM