Facing the possibility of losing your home to foreclosure is a deeply stressful experience. The financial strain, the constant worry, and the legal complexities can feel overwhelming, leaving you searching for a clear path forward. Many Florida homeowners find themselves in this exact position, not just needing basic information, but authoritative guidance on how to truly navigate the intricate process of curing mortgage arrears and preventing default. You’re not alone in seeking a viable solution. The good news is, federal law offers a powerful tool designed precisely for this challenge: Chapter 13 bankruptcy. This isn’t about giving up your assets; it’s a strategic repayment plan designed to give you a fresh financial start, allowing you to catch up on overdue mortgage payments and keep your home. At Gort Law P.A., we understand that you’re evaluating options, weighing risks, and seeking the definitive answer to whether Chapter 13 is the right solution for your unique situation.

Our goal is to empower you with the precise, in-depth insights you need to make a confident, informed decision.

The Immediate Shield: How Chapter 13’s Automatic Stay Halts Florida Foreclosure

The moment a Chapter 13 bankruptcy petition is filed, a powerful legal injunction known as the “automatic stay” immediately goes into effect.

For Florida homeowners, this is often the most critical and immediate benefit.

In Florida, a judicial foreclosure process means your lender must file a lawsuit in court to take your home.

This process can be lengthy, but once a foreclosure judgment is entered, a sale date is typically set. The automatic stay stops all collection actions, including:

- Foreclosure lawsuits and scheduled sales

- Harassing phone calls from creditors

- Wage garnishments

- Bank account levies

This immediate halt provides a crucial breathing room—time for you and your attorney to craft a comprehensive repayment plan without the imminent threat of losing your home.

It effectively presses “pause” on the foreclosure clock, giving you the control you need to strategically address your arrears.

Anatomy of the Chapter 13 Repayment Plan: Your Blueprint to Financial Recovery

A Chapter 13 bankruptcy is often referred to as a “wage earner’s plan” because it allows individuals with regular income to propose a plan to repay all or a portion of their debts over a fixed period, typically three to five years.

Here’s how it generally works:

- Plan Purpose: Your repayment plan is a formal proposal outlining how you intend to repay your creditors, including how you’ll catch up on your mortgage arrears.

- Duration: Most plans last 60 months (five years), particularly if your income exceeds the median for a household of your size in Florida. If your income is below the median, you might have a three-year plan.

- Role of the Trustee: Once your plan is confirmed by the bankruptcy court, you’ll make regular monthly payments to a court-appointed Chapter 13 Trustee. The Trustee collects these payments, deducts their statutory commission (typically up to 10% of payments made through the plan), and then distributes the funds to your creditors according to the terms of your confirmed plan. (AllLaw, undated)

Within this plan, debts are generally categorized and prioritized:

- Priority Debts: These include things like certain taxes, child support, and alimony, which must be paid in full during the plan.

- Secured Debts: These are debts backed by collateral, like your home (mortgage) or car loan. Your plan will specify how you’ll catch up on arrears and continue current payments.

- Unsecured Debts: These are debts without collateral, such as credit card debt, medical bills, or personal loans. The amount you pay on these depends on your disposable income and other plan requirements.

Deep Dive into Curing Mortgage Arrears: Beyond the Basics (The Technicalities & Pitfalls)

This is where the true power of Chapter 13 for homeowners lies.

Unlike a loan modification, which is a negotiation with your lender with no guarantee, Chapter 13 provides a legally binding mechanism to force your lender to accept a structured repayment of your past-due mortgage amounts.

Homeowners often file Chapter 13 when they are around six months behind on payments, with roughly $8,000 in arrears, often including various fees. (Harvard Business Law Review, c. 2013)

However, simply adding up missed principal and interest payments is rarely the full picture.

Defining “Arrears”: A Comprehensive Breakdown

When we talk about “mortgage arrears” in Chapter 13, we’re referring to the total amount you are behind, which can include several components:

- Missed Principal & Interest (P&I) Payments: This is the most obvious part—the monthly mortgage payments you failed to make.

- Escrow Shortages: If your mortgage includes an escrow account for property taxes and homeowner’s insurance, any deficits in this account due to rising costs or underpayment will be added to your arrears. This is a common, often overlooked, component.

- Legitimate Late Fees: Your loan documents specify late fees for missed payments. These can accumulate.

- Foreclosure Costs and Legal Fees: Once a foreclosure action begins, the lender incurs legal fees and costs (e.g., filing fees, service of process, publication costs). These can be added to your arrears if they are reasonable and allowable by your mortgage contract and state law.

The Interest Conundrum on Arrears: What You Need to Know

A common concern is whether interest accrues on the arrears themselves during your Chapter 13 plan. This is a nuanced area:

- For your Principal Residence: Generally, under bankruptcy law, interest does not accrue on the arrears of your primary residence mortgage if your lender is “oversecured” (meaning your home is worth more than the total amount you owe on the mortgage). The contract rate of interest continues to accrue on the outstanding principal balance of the loan, but not on the past-due portion being cured through the plan. The goal is simply to “cure” the default, not pay additional interest on the cured amount itself.

- Dispelling “Till” Rates: You may hear about “Till” interest rates in bankruptcy. This applies primarily to secured debts where the lender’s claim is undersecured (the collateral is worth less than the debt) or for non-purchase money liens. It generally does not apply to the arrears on your principal residence mortgage, which is typically “cured” at the contractual interest rate on the ongoing payments, with no additional interest on the arrears unless the lender’s claim is oversecured and their contract provides for it.

Understanding this distinction is vital to accurately calculating your plan payments and avoiding surprises.

The Crucial Role of Bankruptcy Rule 3002.1: Monitoring Your Mortgage Servicer

This federal bankruptcy rule is your ally in a Chapter 13 plan, but only if you know how to leverage it. Rule 3002.1 requires mortgage servicers to provide specific notices to the court and the debtor throughout your Chapter 13 case:

- Notices of Payment Change (PCN): If your monthly mortgage payment changes due to adjustments in property taxes or insurance premiums (which frequently happens in escrow accounts), your servicer must file a PCN.

- Notices of Postpetition Fees/Charges: If your servicer assesses any fees or charges after your bankruptcy filing (e.g., for property inspections, forced-place insurance, or even post-petition late fees if allowed), they must file a notice with the court.

Why you MUST monitor and object: Mortgage servicer errors are surprisingly common.

These errors, if unchecked, can lead to post-discharge “hidden arrears” or even a new foreclosure action after your bankruptcy case closes, precisely what you filed Chapter 13 to avoid.

You and your attorney must diligently review every notice filed by your servicer.

If you spot inaccurate or unauthorized charges, you have the right to object to them with the bankruptcy court. This proactive monitoring is key to a successful plan.

Practical Arrears Calculation Example (Florida Context)

Let’s illustrate how Chapter 13 cures arrears with a hypothetical Florida homeowner:

Scenario: Sarah, living in Jupiter, Florida, is 6 months behind on her mortgage.

- Original Monthly Payment (P&I + Escrow): $1,500

- Months in Arrears: 6 months

- Accrued Late Fees: $300

- Lender’s Foreclosure Costs/Fees (Pre-petition): $1,000 (e.g., filing fees, attorney’s fees)

Initial Calculation of Mortgage Arrears:

- Missed P&I + Escrow: 6 months * $1,500 = $9,000

- Add Late Fees: $300

- Add Foreclosure Costs: $1,000

- Total Mortgage Arrears (estimated): $10,300

How Chapter 13 Addresses This:

Sarah’s Chapter 13 plan would propose to pay this $10,300 in arrears over the life of her 60-month plan.

- Monthly Arrears Payment: $10,300 / 60 months = ~$171.67 per month.

Here Chapter 13 Plan Payment would then include:

- Ongoing Current Mortgage Payment: Sarah would resume making her regular $1,500 monthly mortgage payments directly to her lender (or through the trustee, depending on local practice).

- Arrears Payment to Trustee: She would pay the ~$171.67 per month to the Chapter 13 Trustee, who then forwards it to her mortgage servicer to cure the $10,300 arrearage.

- Payments for Other Debts: Her plan payment would also include amounts for any other priority debts (like taxes), secured debts (like a car loan, if applicable), and a percentage of her unsecured debts (like credit cards), all distributed by the Trustee.

- Trustee Fee: The Trustee would deduct their fee (up to 10%) from the total payment received from Sarah.

This structured approach makes a large, unmanageable lump sum of arrears digestible over several years, allowing homeowners to stabilize their finances.

Managing Your Mortgage: Current Payments & Potential Challenges During Chapter 13

While your Chapter 13 plan addresses past-due mortgage payments, it’s crucial to understand your ongoing obligations.

Once your bankruptcy case is filed, you are generally expected to resume making your regular monthly mortgage payments on time.

- Direct Pay vs. Conduit Payment: In some Florida bankruptcy courts, Chapter 13 plans require debtors to make their ongoing mortgage payments directly to the lender. In others, the payments might be made through the Chapter 13 Trustee (this is often called a “conduit” payment). Your attorney will advise on the specific practice in your jurisdiction.

- Consequences of Missing Payments: Missing current mortgage payments during your Chapter 13 plan can have severe consequences. Your mortgage servicer can file a “Motion for Relief from Automatic Stay” with the court, asking permission to resume foreclosure proceedings. If granted, you could lose the protection of the bankruptcy and face foreclosure once again. Diligence in making both your plan payments and current mortgage payments is paramount for success.

Chapter 13 vs. The Alternatives: Choosing Your Best Path to Home Retention in Florida

When facing mortgage default, homeowners in Florida have several options.

Chapter 13 isn’t always the only answer, but it often stands out as the most comprehensive solution for those committed to keeping their home.

Here’s a comparison to help you assess your options:

| Feature/Option | Chapter 13 Bankruptcy | Loan Modification | Chapter 7 Bankruptcy (for homeowners) | Short Sale / Deed in Lieu |

| Primary Goal | Keep home, cure arrears, restructure/discharge other debts. | Reduce monthly payment, avoid foreclosure. | Discharge unsecured debt quickly; may lose home if not current or reaffirmed. | Avoid foreclosure, mitigate credit damage. |

| Foreclosure Stop? | Yes, immediate automatic stay | Yes, if approved and payments are made. | Yes, immediate automatic stay (temporary; no direct arrears cure) | Yes, if lender agrees. |

| Arrears Cure? | Yes, structured repayment plan (3-5 years). Legally enforceable. | Maybe, arrears often capitalized into new loan balance (increases total interest) | No direct cure; can discharge mortgage debt if you surrender the home | No, you lose the home. |

| Other Debt Relief? | Yes, consolidates and often discharges a portion of unsecured debt. | No impact on other debts. | Yes, quick discharge of most unsecured debt. | No impact on other debts. |

| Credit Impact | Significant negative impact (on report for 7 years), but improves over time with plan compliance. | Moderate to significant negative (depends on modification terms, payment history). | Significant negative impact (on report for 10 years). | Significant negative impact (less than foreclosure, but still impacts credit). |

| Process Control | Court-supervised, legally binding; structured and predictable. | Lender-driven negotiation; outcome not guaranteed, often lengthy and frustrating. | Court-supervised; quick but less control over secured assets if debt is not paid. | Lender-driven negotiation; you surrender control of the property |

| Cost | Attorney fees, court filing fees, Trustee fees (up to 10% of plan payments). | Minimal application fees; potential legal fees if attorney assistance is sought. | Attorney fees, court filing fees. | Real estate agent fees, potential closing costs; less direct cash outflow from homeowner. |

| Florida Specifics | Navigates Florida’s judicial foreclosure; protects homestead exemption | Lender may prefer this to foreclosure; no state-specific legal enforcement. | Florida homestead exemption still protected if home retained. | Common alternatives to judicial foreclosure in Florida. |

When is Chapter 13 the Optimal Choice for Florida Homeowners?

Chapter 13 is often the optimal choice for Florida homeowners who:

- Are behind on their mortgage payments but want to keep their home.

- Have a stable income to fund a repayment plan.

- Have significant other debts (credit cards, medical bills, car loans) that can be consolidated and managed within the plan.

- Are facing a foreclosure lawsuit and need immediate protection.

- Have equity in their home that they wish to protect (as Chapter 7 might force a sale if equity exceeds exemptions, while Chapter 13 allows you to keep it if you pay its value).

- Need to address specific issues like cramming down car loans or dealing with second mortgages on rental properties (though not on a primary residence).

While Chapter 13 completion rates nationally average around 35%, this figure rises significantly to 70-73% among cases where a plan is actually confirmed.

This highlights that with a well-structured plan and diligent adherence, success is well within reach. (ConsiderChapter13.org, 2016; Acclaim Legal Services, 2020; Victor A. Denaro & Associates, undated)

Life After Chapter 13: Mortgage & Refinancing Opportunities (and Requirements)

A common misconception is that bankruptcy forever bars you from obtaining new credit or refinancing.

While it certainly impacts your credit in the short term, life after Chapter 13 does include opportunities for mortgage and refinancing.

Waiting Periods for New Mortgages Post-Discharge:

- FHA Loans: You may qualify for an FHA loan 1 year after your Chapter 13 discharge, provided you have a good payment history during the plan and can meet FHA’s credit and income requirements.

- VA Loans: Similarly, VA loans are often available 1 year after Chapter 13 discharge, with consistent plan payments.

- USDA Loans: USDA loans typically require 3 years post-discharge.

- Conventional Loans: Waiting periods for conventional loans vary by lender, but are often 2 years post-discharge for Chapter 13 cases completed successfully.

Is it Possible to Refinance While in Chapter 13?

Yes, it is possible, but it requires court and trustee approval.

This is not a common occurrence, but it can happen, particularly for an FHA cash-out refinance if you have built equity and can demonstrate a clear benefit to your bankruptcy estate (e.g., to pay off creditors more quickly or deal with an unexpected financial need).

The process involves filing a motion with the bankruptcy court and obtaining approval from the Chapter 13 Trustee.

Rebuilding Credit After Bankruptcy for Future Homeownership:

Your credit score will take a hit, but it’s not a permanent mark.

By consistently making your Chapter 13 plan payments on time, maintaining current mortgage payments, avoiding new debt, and responsibly using any new, limited credit (e.g., a secured credit card) after discharge, you can gradually rebuild your credit profile and open doors to future financial opportunities, including homeownership or refinancing.

Florida’s Unique Protections: The Homestead Exemption and More

One of the significant advantages for homeowners in Florida is the state’s generous homestead exemption. This protection is vital when considering bankruptcy:

- Unlimited Homestead Exemption: Florida has an unlimited homestead exemption (with some important timing rules). This means that if your primary residence is within the size limits (half an acre within a municipality or 160 acres outside), its value is generally protected from creditors in bankruptcy, provided you’ve owned and resided in the home for at least 1,215 days (approximately 3 years and 4 months) before filing.

- Impact on Chapter 13: This exemption means you can keep your home in Chapter 13 even if you have significant equity, as long as you can make your ongoing mortgage payments and cure any arrears through your plan. It prevents creditors from forcing the sale of your primary residence to pay unsecured debts.

Understanding these Florida-specific nuances is critical when assessing your options.

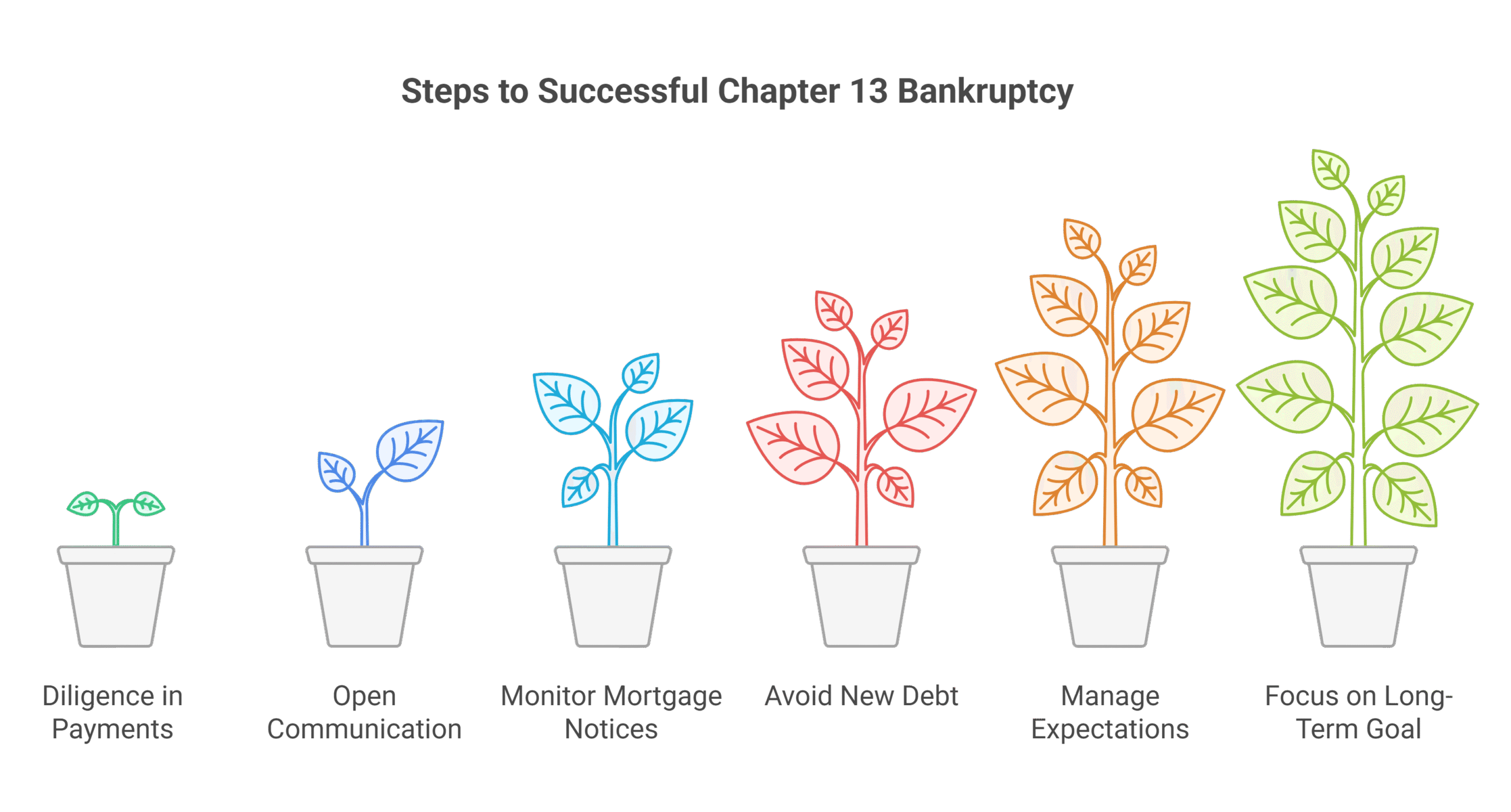

Maximizing Your Chapter 13 Success: Practical Tips and Avoiding Default

The journey through Chapter 13 requires discipline and proactive engagement.

Here are practical tips to help you succeed and avoid defaulting on your plan:

- Diligence in Plan Payments: Make every payment to your Chapter 13 Trustee on time. Consistency is paramount.

- Open Communication with Your Attorney: Your attorney is your guide. Inform them immediately of any changes to your income, expenses, or if you receive unusual communications from your mortgage servicer or other creditors.

- Monitor Mortgage Servicer Communications: Remember Rule 3002.1. Scrutinize every Notice of Payment Change or Notice of Post petition Fees from your mortgage servicer. Alert your attorney to anything that looks incorrect or unexpected. This proactive vigilance can prevent significant problems down the line.

- Avoid New Debt Without Court Approval: Generally, you cannot incur significant new debt (especially secured debt like a car loan or new mortgage) during your Chapter 13 plan without first obtaining permission from the bankruptcy court and the Trustee.

- Manage Expectations with Reality: While Chapter 13 is a powerful tool, it’s a long-term commitment. Economic pressures, such as inflation and rising interest rates (which affect escrow components like taxes and insurance), can impact your disposable income and your ability to fund your plan. (Epiq AACER, July 2025; The MortgagePoint, July 2025; Weltman, March 2025) Be prepared to budget carefully and communicate with your attorney if your financial situation changes.

- Focus on the Long-Term Goal: It’s easy to feel overwhelmed during the multi-year process. Remind yourself that you are actively working towards regaining control of your finances and keeping your home. The psychological relief of having a clear path forward is immense.

Why You Need a Florida Bankruptcy Attorney for Mortgage Arrears

While this guide provides a deep dive into Chapter 13 and mortgage arrears, the intricacies of bankruptcy law, especially when combined with Florida’s judicial foreclosure process, demand expert legal guidance.

Here’s why a seasoned Florida bankruptcy attorney, like Michael A. Gort and the team at Gort Law P.A., is indispensable:

- Navigating Complexity: Federal bankruptcy laws are complex, and their interaction with state foreclosure laws adds another layer of difficulty. An attorney ensures your petition and plan comply with all legal requirements.

- Accurate Arrears Calculation & Challenges: As discussed, calculating arrears is more than simple addition. An attorney can help you verify the Proof of Claim filed by your mortgage servicer, challenge improper charges, and ensure your plan accurately reflects what you owe and how it will be paid.

- Strategic Plan Drafting: Crafting a confirmable Chapter 13 plan that addresses all your debts, including mortgage arrears, and meets your financial goals requires expertise. Your attorney will ensure your plan maximizes your chances of success.

- Mortgage Servicer Oversight: An attorney understands the obligations of mortgage servicers under Bankruptcy Rule 3002.1 and can proactively monitor their filings, object to errors, and protect you from post-discharge “gotcha” arrears.

- Court Representation: From filing your petition to attending creditor meetings and court hearings, your attorney represents your interests, handles objections, and negotiates with creditors and the Trustee on your behalf.

- Holistic Financial Perspective: Attorney Michael A. Gort’s extensive experience as an investment banker, consultant, and executive provides a unique, real-world business perspective that many law firms lack. This allows Gort Law P.A. to offer comprehensive legal solutions tailored to your specific needs, whether you’re dealing with bankruptcy law, complex litigation, or need estate planning & elder law guidance for long-term financial security.

Don’t navigate this highly stressful and complex process alone. The stakes—your home and your financial future—are too high.

Take the first confident step towards securing your home and financial well-being.

Frequently Asked Questions About Chapter 13 and Mortgage Arrears

Q1: How quickly does Chapter 13 stop a foreclosure sale in Florida?

The automatic stay goes into effect immediately upon filing your Chapter 13 petition, halting any pending foreclosure sales, even those scheduled for the same day. However, it is crucial to file before the sale actually occurs.

Q2: Can I include other debts, like credit card debt, in my Chapter 13 plan?

Yes, absolutely. Chapter 13 is a comprehensive debt consolidation and repayment plan. It allows you to include unsecured debts like credit cards, medical bills, and personal loans, typically repaying only a portion of these debts based on your disposable income.

Q3: What happens if my income changes during my Chapter 13 plan?

If your income significantly changes (e.g., job loss, pay cut, or a substantial raise), you should immediately inform your attorney. Your Chapter 13 plan can be modified (amended) by the court to reflect your new financial situation, either by lowering or increasing your payments to ensure the plan remains feasible.

Q4: Are there fees involved in a Chapter 13 bankruptcy?

Yes, there are court filing fees and attorney fees. Chapter 13 is unique in that a significant portion of your attorney fees can often be paid through your repayment plan, making it more accessible. The Chapter 13 Trustee also charges a commission, typically up to 10% of the payments they disburse to creditors. At Gort Law P.A., we offer free initial consultations and transparent pricing with no hidden fees.

Q5: Can I keep my car in Chapter 13 if I’m behind on payments?

Yes, similar to your mortgage, Chapter 13 allows you to catch up on missed car payments (arrears) and continue making your regular car payments through your plan. In some cases, if your car loan is underwater (you owe more than the car is worth), you may even be able to “cram down” the loan to the vehicle’s actual value.

Q6: What is the primary difference between Chapter 7 and Chapter 13 for homeowners?

The core difference is home retention for those behind on payments. Chapter 7 primarily discharges unsecured debts quickly, but it does not provide a mechanism to cure mortgage arrears or stop foreclosure permanently if you are in default. Chapter 13, conversely, is specifically designed to allow you to catch up on arrears over time while keeping your home and reorganizing other debts. If you want to keep your home and are behind on payments, Chapter 13 is almost always the appropriate path.

Secure Your Home, Secure Your Future.

The prospect of losing your home is daunting, but with the right legal strategy, Chapter 13 bankruptcy offers a powerful solution to cure mortgage arrears and protect your property in Florida. At Gort Law P.A., we combine deep legal expertise with real-world business acumen to provide you with personalized, accessible guidance. Our commitment to empowerment through knowledge means we’ll simplify complex legal processes, giving you the clarity and confidence to make informed decisions. Don’t let uncertainty dictate your future.

Schedule your free initial consultation with Gort Law P.A. today. Let us evaluate your unique situation and outline a clear, actionable plan to help you keep your home and achieve a fresh financial start.