You’ve done the basics—set up a will, maybe a revocable trust—and thought your estate plan was handled. But now, with real wealth at stake, a growing business, or a complex family structure, you’re realizing the standard tools won’t cut it. You’re asking deeper questions: How do I shield my assets? Minimize taxes? Ensure my legacy stays intact through legal and financial shifts? This guide is for Floridians ready to move beyond the basics.

We’ll break down advanced trusts and specialized planning strategies designed to protect what you’ve built strategies tailored to Florida’s laws and the unique challenges that come with significant wealth and responsibility.

The Urgency of Advanced Estate Planning in Florida: The 2025 Tax Cliff

There’s a critical reason why now is the time to seriously consider advanced estate planning.

The federal estate tax exemption, currently at a generous $13.61 million per individual for 2025, is poised for a significant reduction after 2025.

This means that if you don’t utilize certain planning strategies now, a substantial portion of your wealth could be subject to federal estate taxes later.

This impending “tax cliff” creates an urgent “use it or lose it” scenario for high-net-worth Floridians, making lifetime gifts and specialized trusts more critical than ever.

This isn’t just about avoiding taxes; it’s about seizing a time-sensitive opportunity to secure your legacy and ensure your assets pass efficiently to your chosen beneficiaries.

Why Florida? Unique Advantages & Considerations for Advanced Planning

Florida offers a unique and generally favorable environment for estate planning, primarily because it has no state-level estate tax or inheritance tax.

This is a significant advantage compared to many other states. However, our state’s laws are dynamic, and staying current is vital for sophisticated planning.

For instance, Florida’s new trust law (SB 262), effective June 20, 2025, grants broader powers to trustees to alter or “decant” existing trusts.

This change can impact the flexibility and adaptability of your existing and future trust structures.

Additionally, the adoption of UFIPA (Uniform Fiduciary Income and Principal Act), effective January 1, 2025, modernizes rules for allocating income and principal within trusts.

These updates underscore the importance of working with an attorney who is not just familiar with estate planning but is actively engaged with and understands the nuances of Florida’s evolving trust code.

Furthermore, Florida’s robust homestead exemption laws offer powerful asset protection for your primary residence, a critical consideration when integrating real estate into your advanced planning.

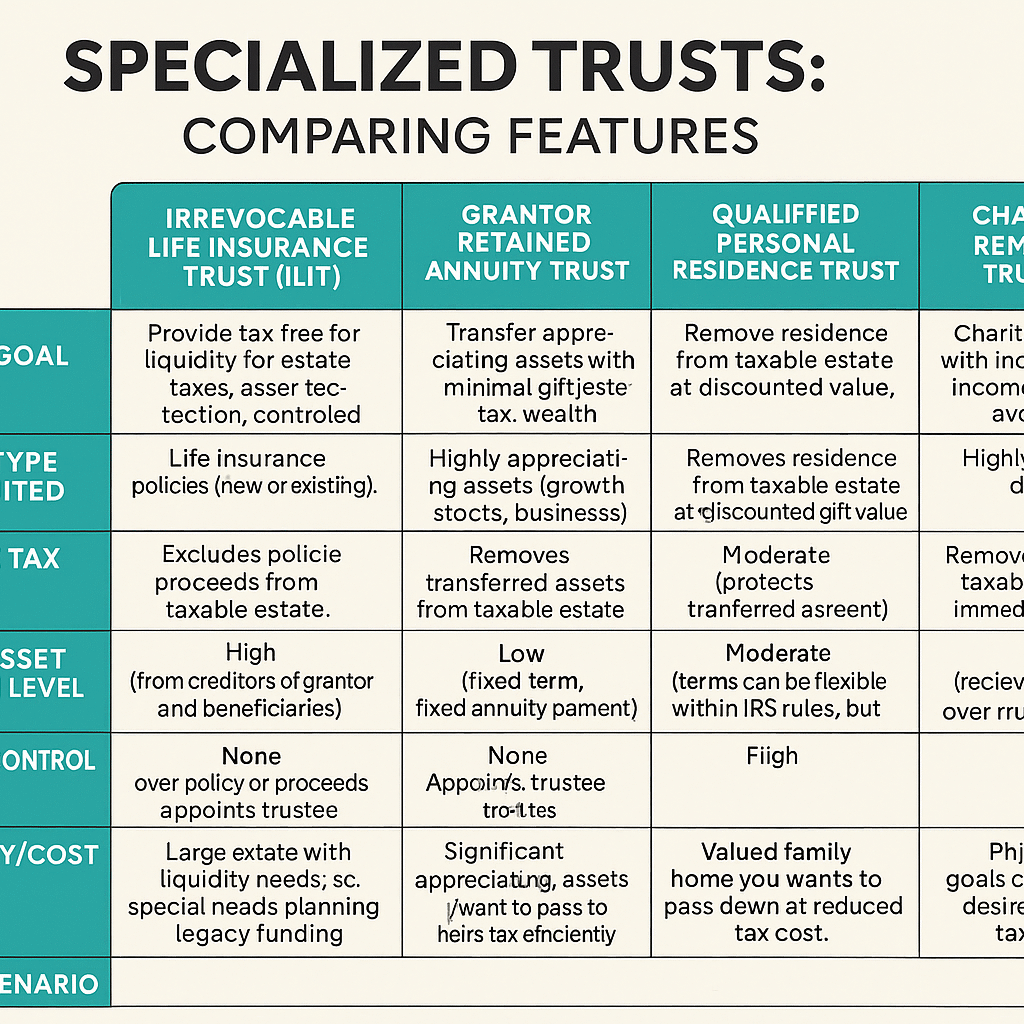

Deep Dive: Specialized Trusts for Sophisticated Goals

Let’s explore some of the most powerful specialized trusts and advanced estate planning tools, detailing how they work, their unique benefits, and what you need to consider for implementation in Florida.

Irrevocable Life Insurance Trusts (ILITs) in Florida

An Irrevocable Life Insurance Trust (ILIT) is a specialized trust designed to own a life insurance policy.

By doing so, the death benefit proceeds are removed from your taxable estate, preventing them from being counted towards the federal estate tax exemption.

This is particularly valuable for high-net-worth individuals who want to provide liquidity for estate taxes, fund a legacy, or protect beneficiaries, without adding to their taxable estate.

How ILITs Work:

You, as the grantor, create the ILIT and name a trustee (who cannot be you). The trust then purchases a new life insurance policy on your life, or you transfer an existing policy to it.

When transferring an existing policy, the beneficiaries of the trust are typically your heirs.

After your passing, the trustee uses the tax-free proceeds of the policy to provide liquidity to your estate (e.g., to pay estate taxes or other expenses) or distributes assets directly to your beneficiaries according to your instructions.

Key Benefits:

- Estate Tax Reduction: The primary benefit is that life insurance proceeds held within an ILIT are generally excluded from your gross estate for federal estate tax purposes, assuming the trust is properly structured and managed. This can provide significant tax savings. [6]

- Asset Protection: Proceeds held in an ILIT can be protected from your creditors and the creditors of your beneficiaries.

- Probate Avoidance: Assets held in an ILIT avoid the probate process, ensuring a quicker, more private distribution to beneficiaries.

- Controlled Distribution: You can dictate how and when beneficiaries receive the funds, which is especially useful for minor children, beneficiaries with special needs, or those who might be financially irresponsible.

- Legacy Funding: An ILIT can fund a charitable legacy or provide a specific inheritance without impacting other estate assets.

Common Pitfalls & Solutions:

- The “3-Year Rule”: If you transfer an existing life insurance policy into an ILIT and die within three years of the transfer, the policy’s proceeds may still be included in your taxable estate. This rule generally doesn’t apply if the ILIT purchases a new policy directly.

- Improper Administration: Failure to follow Crummey notice procedures (annual notification to beneficiaries about their withdrawal rights) can jeopardize the gift tax exclusion.

- Choosing the Right Trustee: Your trustee must be independent and understand their fiduciary duties. They manage the trust, pay premiums, and ultimately distribute proceeds.

- Funding the Trust: ILITs typically require ongoing funding (gifts) to pay policy premiums.

Scenario: Consider the Roberts family, who have a substantial estate and a child with special needs. They worry about how their estate will pay future estate taxes without liquidating assets, and how their child will be cared for financially after they’re gone. By establishing an ILIT, they can purchase a large life insurance policy. The ILIT holds the policy, keeping the death benefit out of their taxable estate. Upon their passing, the tax-free proceeds provide ample liquidity for any estate taxes and can be directed to a separate special needs trust (a common sub-silo) for their child’s long-term care, ensuring their needs are met without jeopardizing government benefits.

Grantor Retained Annuity Trusts (GRATs) in Florida

A Grantor Retained Annuity Trust (GRAT) is an advanced estate planning tool used to transfer appreciating assets to beneficiaries with minimal or no gift tax consequences.

It’s particularly effective when interest rates are low and you anticipate significant appreciation in a specific asset, like shares in a growing business or highly appreciated stock.

How GRATs Work:

You, as the “grantor,” transfer appreciating assets into an irrevocable GRAT for a fixed term (e.g., 2-10 years).

In return, the GRAT pays you a fixed annuity amount each year during the trust term.

This annuity payment is calculated to “zero out” the initial gift value for gift tax purposes or reduce it significantly.

If the assets inside the GRAT grow faster than the IRS’s assumed interest rate (the “7520 rate”), the excess growth passes to your beneficiaries (usually children or grandchildren) free of gift and estate taxes at the end of the term.

Key Benefits:

- Minimize Gift & Estate Tax: The primary benefit is transferring significant wealth (the appreciation above the 7520 rate) to heirs without incurring gift or estate taxes.

- Wealth Transfer Efficiency: It’s an efficient way to transfer appreciating assets out of your estate.

- Retained Income Stream: You receive an income stream (the annuity) during the trust term.

Common Pitfalls & Solutions:

- Grantor Dying Before Term: If you die before the GRAT term ends, the full value of the assets (or a portion) may be included in your taxable estate, defeating the purpose. A strategy like “rolling GRATs” (creating a series of short-term GRATs) can mitigate this risk.

- Valuation Challenges: Proper valuation of the transferred assets is crucial.

- Assets Not Appreciating: If the assets don’t appreciate as expected, or decline in value, the strategy may not be effective. The assets would return to the grantor, but the legal and administrative costs would still be incurred.

- Debt in Excess of Basis: If you transfer assets with debt in excess of basis into a GRAT, it can trigger immediate income tax consequences.

Scenario: Imagine a Florida entrepreneur, Ms. Lee, who owns a significant stake in a rapidly growing tech startup. She wants to transfer a portion of her shares to her children without incurring a hefty gift tax bill. She establishes a GRAT, transfers some of her stock into it, and receives annual annuity payments. If the stock appreciates significantly beyond the IRS 7520 rate during the GRAT term, the “excess” growth passes to her children entirely tax-free, effectively moving a substantial amount of wealth out of her taxable estate

Qualified Personal Residence Trusts (QPRTs) in Florida

A Qualified Personal Residence Trust (QPRT) is a specialized irrevocable trust designed to transfer your primary or secondary residence (like a valuable Florida vacation home) to your beneficiaries at a significantly reduced gift tax cost, while you retain the right to live in it for a specified period.

How QPRTs Work:

You transfer your home into a QPRT for a set number of years. During this “retained interest” period, you continue to live in the home rent-free.

Because you are retaining the right to use the property for a period, the value of the gift for gift tax purposes is significantly discounted (as the IRS values the gift as the future value of the property, not its current value).

At the end of the retained interest period, the home passes to your chosen beneficiaries (e.g., children or grandchildren) outside of your taxable estate.

Key Benefits:

- Estate Tax Reduction: Removes the value of your residence from your taxable estate, “freezing” its value for estate tax purposes at the time of transfer. This is particularly beneficial for homes in appreciating markets like Florida.

- Discounted Gift Tax Value: The value of the gift for gift tax purposes is discounted because you retain the right to live in the home for a period.

- Preserve Family Legacy: Allows you to pass down a cherished family home to the next generation while minimizing associated taxes.

Common Pitfalls & Solutions:

- Grantor Dying Before Term: If you die before the retained interest term ends, the full value of the home will be included in your taxable estate, negating the tax benefits. Choosing a shorter term can reduce this risk.

- Loss of Control: Once transferred to the QPRT, you no longer own the home directly. You’re giving away future ownership.

- QPRT Re-renting Pitfalls: After the retained interest period ends, if you wish to continue living in the home, you must pay fair market rent to the new owners (your beneficiaries). It is crucial to have a formal lease agreement and ensure rental payments are consistent and at market rate to avoid re-inclusion in your estate by the IRS. Florida tenancy laws must also be considered in drafting this lease. [9, 13]

- Capital Gains Basis: Your beneficiaries receive the home with a “carryover basis,” meaning they inherit your original cost basis. If they sell the home later, they may face a larger capital gains tax than if they had inherited it with a “stepped-up” basis at your death.

Scenario: The Ramirez family owns a beautiful waterfront property in Jupiter, Florida, that has been in their family for generations. They want to ensure it passes to their children with minimal estate tax burden. They establish a QPRT, transferring the home into it for a 15-year term. They continue to live in the home. After 15 years, the home is owned by their children, out of the Ramirez’s estate, having transferred at a discounted gift tax value years earlier.

Charitable Trusts in Florida Estate Planning

For philanthropic individuals and families, charitable trusts offer a powerful way to integrate giving with financial planning, providing significant tax benefits while supporting causes you care about.

These trusts can be structured to provide you with an income stream, reduce your current income or estate taxes, and ultimately benefit a charity.

Types:

- Charitable Remainder Trusts (CRTs):

- CRAT (Charitable Remainder Annuity Trust): Pays a fixed annuity amount each year to you (or other non-charitable beneficiaries) for a set term or life. The remainder goes to charity.

- CRUT (Charitable Remainder Unitrust): Pays a fixed percentage of the trust’s fair market value (revalued annually) to you (or other non-charitable beneficiaries) for a set term or life. The remainder goes to charity.

- Charitable Lead Trusts (CLTs): The inverse of CRTs. A CLT pays an annuity or unitrust amount to a charity for a set term, after which the remainder (which may have appreciated significantly) goes to your non-charitable beneficiaries (e.g., family members).

Key Benefits:

- Income Stream: CRTs provide an income stream to you or other beneficiaries.

- Immediate Tax Deductions: You can receive an immediate income tax deduction when funding a CRT or CLT.

- Capital Gains Tax Avoidance: When appreciated assets are transferred to a CRT, the trust can sell them without immediate capital gains tax.

- Philanthropic Legacy: Ensures your chosen charities receive a substantial gift, reflecting your values.

- Estate Tax Reduction: Assets transferred to a charitable trust are removed from your taxable estate.

Common Challenges & Solutions:

- Fiduciary Responsibilities: Charitable trusts require careful administration to ensure compliance with IRS rules and Florida law.

- Compliance: Annual filing requirements and strict regulations must be followed.

- Balancing Intent: Structuring the trust to balance your income needs with your charitable goals is crucial.

- Choosing the Right Charity: Ensuring the recipient charity qualifies and aligns with your long-term vision.

Scenario: Ms. Chen, a successful retired business owner in Fort Pierce, wants to support her favorite animal rescue while also creating a secure income stream for herself and minimizing her estate’s tax burden. She establishes a Charitable Remainder Unitrust (CRUT), funding it with highly appreciated stock. The CRUT sells the stock tax-free, invests the proceeds, and pays her a percentage of the trust’s value annually. Upon her death, the remainder of the trust goes to the animal rescue, fulfilling her philanthropic vision.

Emerging Frontiers: Digital Assets & SECURE Act 2.0 in Florida Trusts

The world of estate planning is constantly evolving.

Two areas demanding increased attention, especially for specialized trusts, are digital assets and the implications of the SECURE Act 2.0.

Many traditional estate plans overlook these crucial components, creating significant gaps.

Digital Assets: Securing Your Online Legacy

In our increasingly digital world, your “assets” extend far beyond physical property and financial accounts.

Digital assets include everything from cryptocurrency, NFTs, and online brokerage accounts to social media profiles, email accounts, and cloud storage.

Florida’s Fiduciary Access to Digital Assets Act (FADAA) provides a framework, but merely having a law isn’t enough; proactive planning is essential.

Practical Steps for Your Trust:

- Inventory: Create a comprehensive, regularly updated inventory of all your digital assets, including usernames, passwords (use a secure password manager), and where they are stored.

- Identify Custodians: Note the companies (custodians) that hold your digital assets (e.g., Coinbase for crypto, Google for email).

- Designate a Fiduciary: Through your trust documents, explicitly grant your trustee (and/or personal representative) the authority to access, manage, and distribute your digital assets. Be as specific as possible, detailing which assets they can access and for what purpose.

- Consider Provider Policies: Be aware that some online service providers have terms of service that may conflict with your wishes or state law. Discuss strategies with your attorney to navigate these.

- Storage: Never store passwords directly in your trust documents. Instead, use secure, encrypted methods, and provide your fiduciaries with a pathway to access them after your passing.

Integrating digital asset planning into specialized trusts, particularly those designed for long-term wealth management or specific beneficiaries, ensures a truly comprehensive legacy plan.

SECURE Act 2.0 Impact on Trusts: Navigating Retirement Account Distributions

The original SECURE Act (2019) introduced the 10-year distribution rule for most inherited IRAs, effectively eliminating the “stretch IRA” for many beneficiaries.

SECURE Act 2.0 (2022) further refined these rules, adding layers of complexity.

This directly impacts how retirement accounts, often significant assets, interact with your trusts, especially “see-through” and “conduit” trusts.

Key Implications for Your Florida Trusts:

10-Year Rule: Most non-eligible designated beneficiaries (e.g., adult children who are not disabled/chronically ill) inheriting an IRA through a trust must withdraw all funds within 10 years of the original owner’s death.

This can accelerate income tax liabilities.

See-Through vs. Conduit Trusts:

- “Conduit” Trusts: Require the trustee to immediately pass any RMDs (Required Minimum Distributions) from the inherited IRA directly to the trust beneficiary. This forces the 10-year payout.

- “Accumulation” or “See-Through” Trusts: Allow the trustee to retain the RMDs within the trust rather than distributing them immediately. This provides asset protection but can result in the trust paying much higher income tax rates if the income is not distributed.

- Necessary Adjustments: Review your trusts to ensure they are structured optimally under SECURE Act 2.0. For example, if your trust for a beneficiary allows for accumulation, understand the tax implications. If you want to protect a spendthrift beneficiary, an accumulation trust might still be preferred despite the higher tax rate.

- Special Needs Trusts: For beneficiaries with disabilities or chronic illnesses, specific exceptions to the 10-year rule apply. Ensure your special needs trust is correctly drafted to qualify for these exceptions and maintain the beneficiary’s eligibility for government benefits.

Understanding these implications and adjusting your trust language is crucial to prevent costly tax traps and ensure your retirement savings benefit your heirs as intended.

Choosing Your Path: A Comparative Decision Framework

Remember, these are not mutually exclusive. A comprehensive plan often involves a combination of these and other tools.

For instance, an Irrevocable Life Insurance Trust might provide the liquidity needed to cover estate taxes on other assets transferred via a GRAT or QPRT.

Partnering with an Expert Florida Estate Planning Attorney

Navigating the complexities of specialized trusts and advanced estate planning in Florida demands more than just a passing understanding of the law.

It requires deep expertise, a forward-looking perspective, and the ability to integrate legal strategies with your broader financial and life goals.

At Gort Law P.A., we understand that you’re not just looking for legal documents; you’re seeking a trusted advisor who can empower you to make confident decisions about your legacy.

Attorney Michael A. Gort brings a unique blend of legal and real-world business experience to the table, having worked as an investment banker, consultant, and executive before founding Gort Law.

This background means he understands not only the intricate legal frameworks but also the financial implications and strategic considerations that truly impact high-net-worth individuals and business owners.

Our commitment to personalized service and virtual consultations means we meet you where you are, providing accessible, tailored legal solutions.

We’ve been recognized for outstanding service by organizations like the American Bar Association Military Pro Bono Project and hold an A+ rating from the Better Business Bureau, underscoring our dedication to ethical practices and client satisfaction.

Frequently Asked Questions About Advanced Trusts

Q1: Is an irrevocable trust truly “irrevocable”? Can anything be changed?

While “irrevocable” means you generally cannot amend or revoke the trust after it’s created, Florida law does provide some flexibility. With the consent of all beneficiaries and certain legal processes (like “decanting” or judicial modification), an irrevocable trust can sometimes be modified. Florida’s new trust law (SB 262, effective June 20, 2025) even grants broader decanting powers to trustees in certain situations, highlighting the need for up-to-date legal counsel.

Q2: What’s the difference between a will and a trust? Do I need both?

A will dictates how your assets are distributed after your death, typically requiring probate. A trust, particularly an irrevocable one like those discussed, holds assets during your lifetime and distributes them outside of probate, often offering more control, privacy, and tax advantages. For sophisticated planning, you typically need both: a trust for managing specific assets and goals, and a “pour-over” will to ensure any assets not titled in the trust at your death are transferred into it. Learn more about the differences between a will and a trust here: Wills vs. Trusts.

Q3: How do specialized trusts protect assets from creditors?

Assets properly transferred to an irrevocable trust are no longer legally owned by you. Since they are no longer your personal assets, they are generally protected from your future creditors, lawsuits, and even divorce proceedings. The specific level of protection depends on the type of trust, how it’s structured, and when assets are transferred.

Q4: How long does it take to set up an advanced trust?

The timeline varies depending on the complexity of your situation and the specific trust. Generally, after your initial consultation and gathering all necessary financial information, the drafting and execution process can take several weeks to a few months. The most time-consuming part can often be titling assets into the trust, which is crucial for the trust to be effective.

Q5: What happens if I move out of Florida after setting up a trust?

Generally, a trust properly established under Florida law will remain valid even if you move to another state. However, the laws of your new state of residence may have different tax implications, rules regarding trustee powers, or asset protection nuances. It’s always advisable to have your estate plan reviewed by an attorney in your new state to ensure it remains optimized and compliant.

Take the Next Step Towards a Confident Future

You’ve invested a lifetime in building your wealth. Now, it’s time to ensure it’s protected, optimized, and seamlessly transferred according to your wishes.

The unique combination of legal expertise and real-world business acumen at Gort Law P.A. positions us as your ideal partner in this critical endeavor.

Don’t let the approaching tax changes or the complexities of advanced planning create uncertainty. Let us help you navigate the landscape with clarity and confidence.

Whether you’re considering strategies for wealth transfer, asset protection, or charitable giving, we are here to provide tailored solutions.

Ready to discuss your unique situation and explore the advanced estate planning strategies that align with your goals? Schedule a free initial consultation with Gort Law P.A. today.

Your legacy deserves nothing less than authoritative, personalized guidance.