You’ve tried to stay afloat—cutting expenses, juggling bills, maybe even dipping into savings—but the debt keeps piling up. It’s exhausting. You know something has to change, and bankruptcy might be the lifeline you need. But now you’re stuck at a crossroads: Chapter 7 or Chapter 13? The names sound like codes, and the rules feel like they’re written for lawyers, not real people trying to catch a break. At Gort Law P.A., we’ve walked this road with countless Floridians who felt just as overwhelmed. This guide is here to clear the fog.

We’ll break down what really matters—how your income fits into the picture, what the federal Means Test is all about, how Florida’s laws factor in, and what past filings might mean for your future.

No jargon, no guesswork—just the clarity you need to make the right move.

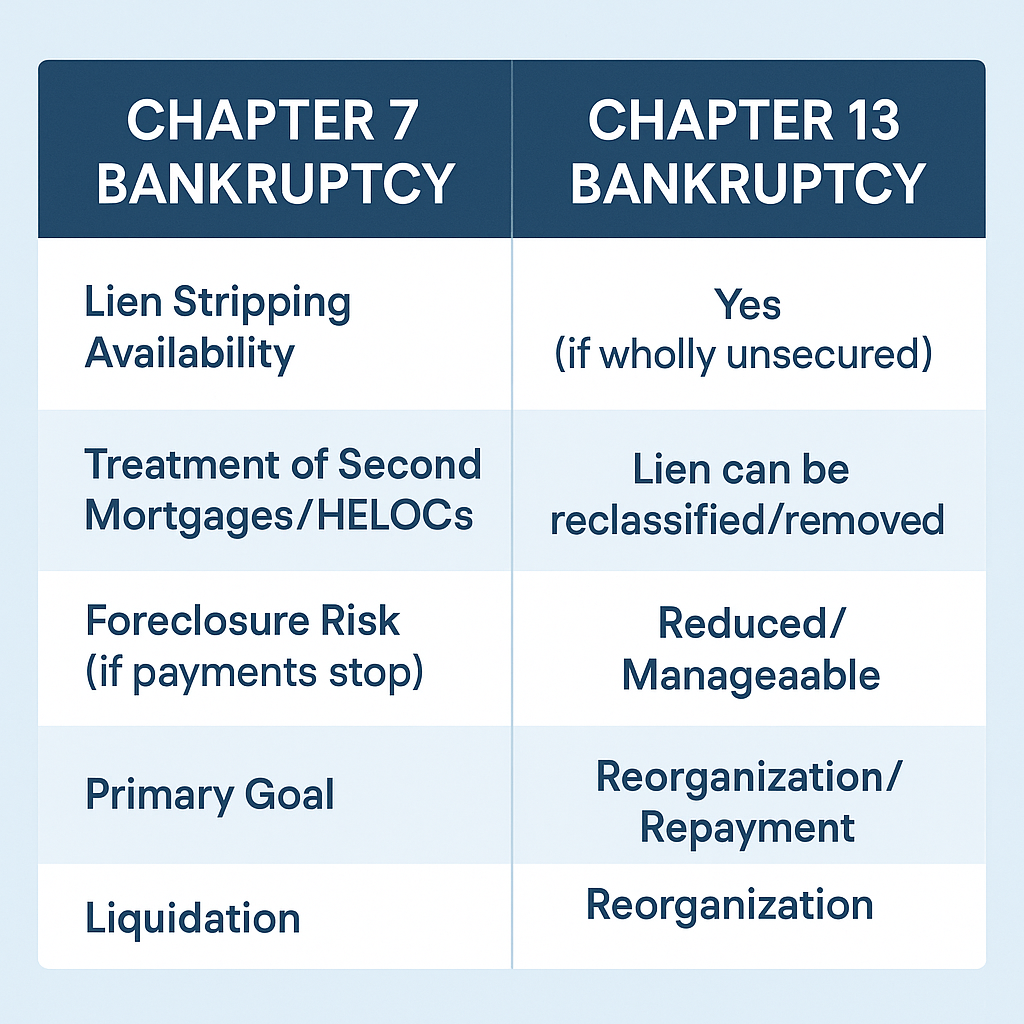

Chapter 7 vs. Chapter 13: A Side-by-Side Comparison for Floridians

Both Chapter 7 and Chapter 13 bankruptcy offer powerful debt relief under federal law, but they operate very differently, especially concerning income and assets.

Deciding between the two is less about a preference and more about a qualification. Understanding these distinctions is your first, most vital step.

Chapter 7, often called “liquidation bankruptcy,” aims to discharge most unsecured debts (like credit card debt, medical bills) quickly, typically within 3-6 months.

It’s generally for individuals with limited income and few assets beyond what can be protected by exemptions.

Chapter 13, known as “reorganization bankruptcy,” allows individuals with regular income to repay a portion of their debts through a court-approved payment plan, typically lasting three to five years.

It’s often chosen by those who earn too much to qualify for Chapter 7, want to save their home from foreclosure, or need to address non-dischargeable debts through a structured plan.

Here’s a quick overview of how these two chapters compare:

Remember, your specific situation will dictate which chapter is suitable. Florida, with its unique laws and significant bankruptcy filing volume—ranking as the second-highest state for total bankruptcy filings in the U.S. with approximately 37,156 filings in 2024 (The Bankruptcy Law Firm, citing U.S. Courts/Epiq data, Aug 4, 2025)—has many residents seeking this clarity.

The Florida Means Test for Chapter 7 Eligibility: Your Income Matters

The Means Test is the cornerstone of Chapter 7 eligibility for most individuals.

It’s a calculation designed to determine if your income is low enough to justify discharging your debts without a repayment plan.

This test is crucial because it ensures that only those who truly cannot afford to repay their debts receive Chapter 7 relief.

The test generally looks at your average gross income over the six months before you file for bankruptcy.

This is often referred to as your “Current Monthly Income” (CMI). If your annualized CMI is below a certain threshold—the median income for a household of your size in Florida—you generally pass the Means Test and qualify for Chapter 7 bankruptcy.

Step 1: Comparing Your Income to Florida’s Median

The U.S. Department of Justice updates these median income figures regularly. It’s vital to use the absolute latest data to ensure accuracy.

As of April 1, 2025, federal Bankruptcy Code dollar thresholds were adjusted, including those impacting the Means Test, reflecting over a 13% increase due to inflation (U.S. Bankruptcy Court, Northern District of Florida, Feb 25, 2025).

Here are approximate Florida median income figures by household size, effective April 1, 2025 (data updated April 1, 2025, via justice.gov/ust):

Florida Median Income by Household Size (Annualized)

| Household Size | $65,500 |

| 2-person | $80,750 |

| 3-person | $93,500 |

| 4-person | $108,500 |

| For each additional person, add | $9,900 |

If your current monthly income, when annualized, is below the median for your household size in Florida, you’re likely to qualify for Chapter 7.

Step 2: Disposable Income Calculation & Allowed Deductions

If your income is above the median, the Means Test proceeds to a second part, which is more complex.

Here, the court examines your “disposable income”—what’s left after subtracting certain allowed expenses from your income.

These expenses are determined by IRS National and Local Standards, as well as actual necessary expenses.

Allowed deductions can include:

- Secured debt payments (like your mortgage or car loan payments).

- Priority debts (such as recent tax obligations or domestic support obligations).

- Health insurance, disability insurance, and term life insurance premiums.

- Child care costs.

- Mandatory payroll deductions (e.g., union dues, retirement plan contributions).

- Charitable contributions (up to 15% of your gross income).

The goal of this second step is to see if, even with an above-median income, you genuinely don’t have enough “disposable income” to make meaningful payments to your unsecured creditors.

This part of the test is highly nuanced, and a miscalculation can lead to a Chapter 7 dismissal.

The “Business Debt” Exception

For some individuals, especially small business owners or those with significant business-related liabilities, the Means Test might not even apply.

If more than 50% of your total non-mortgage debt is classified as “business debt,” you are generally exempt from the Means Test requirements and can qualify for Chapter 7 regardless of your income.

This is a critical detail often overlooked by general legal resources, but it’s a significant advantage for specific filers in Florida.

Chapter 13 Eligibility: Regular Income, Debt Limits & Repayment Plans

If you don’t qualify for Chapter 7 due to the Means Test, or if you have specific goals like saving your home from foreclosure, Chapter 13 bankruptcy might be your solution.

Eligibility for Chapter 13 rests on different criteria:

- Regular Income Requirement: You must have a stable and regular source of income to fund your repayment plan. This doesn’t just mean a traditional paycheck; it can include self-employment income, pensions, social security, disability payments, or even unemployment benefits, as long as it’s consistent.

- Debt Limits: Chapter 13 has specific debt limits. As of April 1, 2025, for individual filers, your unsecured debts (like credit cards, medical bills) cannot exceed $1,395,875, and your secured debts (like mortgages, car loans) cannot exceed $4,192,750 (U.S. Bankruptcy Court, Northern District of Florida, Feb 25, 2025). These amounts are subject to change every three years based on inflation. If your debts exceed these caps, Chapter 13 is not an option, and you might need to consider a Chapter 11 filing.

- The Chapter 13 Repayment Plan Framework: If eligible, you propose a repayment plan to the court. This plan typically lasts three to five years, during which you make regular payments to the bankruptcy trustee. The amount you pay is based on your disposable income (similar to the second part of the Means Test, but applied differently) and the value of your non-exempt assets. Priority debts (like certain taxes or child support) must be paid in full through the plan, and secured creditors usually receive regular payments.

Florida Bankruptcy Exemptions: Protecting Your Property

One of the most significant considerations when choosing between Chapter 7 and Chapter 13, beyond income, is how your assets will be treated.

Florida offers some of the most generous bankruptcy exemptions in the U.S., allowing debtors to protect significant property from liquidation.

The Florida Exemption Advantage

Exemptions allow you to keep certain types of property up to a specified value.

In Chapter 7, exempt property is protected, while non-exempt property may be sold by the trustee.

In Chapter 13, you keep all your property, but the value of your non-exempt assets impacts how much your unsecured creditors must be paid through your repayment plan.

Key Florida Exemptions Explained (with latest figures):

- Homestead Exemption: Florida’s homestead exemption is famously robust. It allows an unlimited amount of value in your home and up to half an acre in a municipality, or 160 acres outside a municipality, to be protected from creditors. However, there’s a crucial residency rule: to claim the full homestead exemption, you must have owned the property for at least 1,215 days (approximately 3.3 years) prior to filing. If you’ve owned it for less than 1,215 days but more than 730 days (2 years), the protection is capped at $189,050 (Nolo, Apr 10, 2025). This specific detail is a key decision factor for many Floridians.

- Personal Property Exemption: You can exempt up to $1,000 in personal property (like furniture, electronics, clothing).

- Wildcard Exemption: If you don’t use the homestead exemption (e.g., you rent or don’t meet the residency requirements), you can claim a $4,000 “wildcard” exemption for any personal property.

- Vehicle Exemption: You can protect up to $1,000 in equity in a single motor vehicle.

- Pensions, Annuities, Public Benefits, and Insurance: Florida law provides strong protections for most pensions, annuities, public benefits (like Social Security, unemployment compensation), and the cash surrender value of life insurance policies.

- Wage Garnishment Protection: Florida also protects wages from garnishment, except for certain types of debts like child support or alimony.

Understanding these exemptions is vital because they determine what you can keep.

An experienced attorney can help you navigate these complex rules to maximize your protections.

Impact of Prior Bankruptcy Filings on Future Eligibility in Florida

Your past bankruptcy filings can significantly affect your ability to file again and, more importantly, receive a discharge of your debts.

Federal law imposes “look-back” periods between filings for different chapters:

- Chapter 7 to Chapter 7: You must wait 8 years from the date you filed your previous Chapter 7 case to file another Chapter 7 and receive a discharge.

- Chapter 13 to Chapter 7: You must wait 6 years from the date you filed your previous Chapter 13 case to file a Chapter 7 and receive a discharge. However, this period can be shorter if your Chapter 13 plan paid 100% of unsecured debts, or paid at least 70% and was filed in good faith.

- Chapter 7 to Chapter 13: You must wait 4 years from the date you filed your previous Chapter 7 case to file a Chapter 13 and receive a discharge.

- Chapter 13 to Chapter 13: You must wait 2 years from the date you filed your previous Chapter 13 case to file another Chapter 13 and receive a discharge.

It’s crucial to note that while you might be able to file a case before these periods expire, you may not be able to receive a discharge of your debts, which is the primary goal of bankruptcy.

If you’ve filed recently, Chapter 13 might be your only viable option to manage debts, even if you can’t discharge them immediately.

This is a complex area where personalized legal advice is indispensable.

Non-Dischargeable Debts: What Bankruptcy Can’t Erase

It’s important to understand that not all debts can be discharged in bankruptcy. Common examples of non-dischargeable debts include:

- Most student loans (unless you can prove “undue hardship,” which is very difficult to do).

- Recent tax debts (generally those less than three years old).

- Child support and alimony obligations (domestic support obligations).

- Debts for personal injury or death caused by driving under the influence.

- Debts incurred through fraud or false pretenses.

- Fines or penalties owed to government units.

While Chapter 7 generally cannot discharge these debts, Chapter 13 can sometimes manage them.

For example, a Chapter 13 plan can help you catch up on past-due tax arrears or child support payments, allowing you to avoid penalties or further legal action.

Strategic Advantages of Chapter 13: Beyond Just Qualifying

Beyond just qualifying for Chapter 13, this chapter offers powerful strategic advantages that Chapter 7 does not.

It can be a highly effective tool for debt management and asset protection, particularly for Floridians:

- Stopping Foreclosure & Repossession: Filing Chapter 13 immediately triggers an “automatic stay,” halting collection actions, including home foreclosures and vehicle repossessions. Your Chapter 13 plan can then allow you to catch up on past-due payments (arrears) over the 3-5 year period.

- Cramdowns: In certain situations, Chapter 13 allows you to “cram down” the balance of a secured loan (like a car loan or investment property mortgage) to the current market value of the collateral, rather than what you owe. This can significantly reduce your payments. This applies to vehicles purchased more than 910 days (about 2.5 years) before filing.

- Lien Stripping: If you have a second or third mortgage (or other junior liens) on your home, and the value of your home is less than what you owe on your first mortgage, Chapter 13 may allow you to “strip off” those junior liens. This means they are reclassified as unsecured debt and can be discharged at the end of your plan, just like credit card debt.

- Protecting Co-Signers: Chapter 13 includes a co-debtor stay, which protects individuals who co-signed debts with you from collection efforts, something Chapter 7 does not offer.

These advanced strategies highlight how Chapter 13 isn’t just a fallback option; it’s a powerful tool for complex financial situations, especially when paired with an attorney’s deep understanding of Florida bankruptcy options.

Common Mistakes & Pitfalls to Avoid in Florida Bankruptcy Filings

Navigating bankruptcy can be complex, and even small errors can lead to delays, dismissals, or even allegations of fraud.

Based on our experience helping clients in Jupiter and throughout Florida, here are some common pitfalls to avoid:

- Means Test Errors: Incorrectly calculating your Current Monthly Income, overlooking legitimate deductions, or failing to factor in the “business debt” exception can lead to a Chapter 7 case being dismissed. These errors often stem from a lack of detailed understanding of the IRS standards and specific local allowances.

- Failing to Disclose All Assets or Debts: You must be completely honest and transparent about all your financial affairs. Intentionally hiding assets or debts is bankruptcy fraud and carries severe penalties.

- Improperly Claiming Exemptions: Misunderstanding Florida’s exemption laws, especially the crucial residency requirements for the homestead exemption, can put your property at risk. Many attempt to “finesse” exemptions, which is a dangerous path.

- Not Completing Required Credit Counseling: Before filing, all individuals must complete a credit counseling course from an approved agency. Failing to do so will result in your case being dismissed.

- Transferring Property Before Filing: Transferring assets to family members or friends shortly before filing bankruptcy can be viewed as an attempt to defraud creditors and lead to serious legal consequences.

These mistakes underscore the intricate nature of bankruptcy law and the importance of professional guidance.

Making Your Informed Decision: When to Consult a Florida Bankruptcy Attorney

Understanding the nuances of Chapter 7 and Chapter 13 eligibility, especially with Florida-specific rules and constantly updated federal thresholds, is a significant undertaking.

While this guide provides a comprehensive overview, your unique financial situation demands personalized attention.

At Gort Law P.A., we don’t just process paperwork; we provide a strategic partnership.

Our founder, Michael A. Gort, leverages his extensive experience as an investment banker, consultant, and executive, combined with his legal expertise, to offer a perspective that goes beyond typical legal advice.

We analyze your income, assets, debts, and goals to recommend the most advantageous path for you.

Whether you’re struggling with overwhelming debt, facing civil litigation, or planning for your future with estate planning, our tailored solutions are designed to provide a fresh financial start.

We offer free initial consultations, ensuring transparency with no hidden fees, so you can understand your options without added financial burden.

This commitment to accessibility is why Gort Law P.A. holds an A+ rating from the Better Business Bureau (bbb.org).

Don’t navigate this complex journey alone. Your financial future is too important.

FAQs about Florida Bankruptcy Eligibility

Q: What is “disposable income” in the context of the Means Test?

A: Disposable income is the amount of income you have left after subtracting allowed expenses from your gross income. For the Means Test, these allowed expenses are primarily based on IRS National and Local Standards, as well as certain actual necessary expenses like secured debt payments and priority debts. If you have too much disposable income, you may not qualify for Chapter 7.

Q: Can I file for Chapter 7 bankruptcy if I own a home in Florida?

A: Yes, many Floridians who own homes qualify for Chapter 7, primarily due to Florida’s generous homestead exemption. This exemption protects the value of your primary residence, often allowing you to keep your home even in Chapter 7, provided you meet specific residency and ownership requirements (1,215 days of ownership for full protection, or a cap if owned for less than 1,215 days but more than 730 days).

Q: How do I know if I have “regular income” for Chapter 13?

A: “Regular income” for Chapter 13 is broadly defined. It means any income that is sufficiently stable and regular to enable you to make consistent payments under a Chapter 13 plan. This can include wages, self-employment income, retirement benefits, social security, disability payments, or even rental income. The key is consistency and predictability.

Q: What happens if I file for bankruptcy but don’t qualify for Chapter 7?

A: If you don’t qualify for Chapter 7 after the Means Test, your case may be presumed to be an “abuse” of the bankruptcy system. In such scenarios, you typically have two options: convert your case to a Chapter 13 bankruptcy (if you qualify) or have your Chapter 7 case dismissed. This is where the strategic guidance of an attorney becomes vital.

Q: How often do the bankruptcy income limits and debt caps change?

A: The median income figures used in the Means Test are updated by the U.S. Trustee Program approximately twice a year. The federal dollar thresholds for Chapter 13 debt limits and certain other bankruptcy amounts are adjusted every three years, on April 1st, to account for inflation. The most recent adjustment was on April 1, 2025. It’s crucial to use the latest figures when assessing eligibility.

Q: Can bankruptcy help with student loan debt in Florida?

A: Student loan debt is generally very difficult to discharge in bankruptcy, whether Chapter 7 or Chapter 13. You must prove “undue hardship,” a very strict legal standard. However, Chapter 13 can sometimes help by allowing you to prioritize other debts while potentially deferring student loan payments or preventing collection actions for the duration of your repayment plan.

Ready to explore your Florida bankruptcy options and determine the best path forward?

We’re here to provide the clarity and confidence you need. Contact Gort Law P.A. today for a free, confidential consultation.