Navigating life after bankruptcy can feel like stepping onto unfamiliar ground. The immediate relief of discharge is often quickly followed by a crucial question: “Now what?” Many worry about the lasting impact on their credit, their ability to secure loans, or even their fundamental financial stability. If you’re comparing solutions for your post-bankruptcy recovery, you’re not alone. This pivotal moment is less about what you’ve left behind and more about the strategic path you forge ahead.

This guide is designed to empower you with the insights you need to confidently rebuild your financial life, whether you’ve filed for Chapter 7 or Chapter 13 bankruptcy.

We’ll demystify the credit landscape, explain how to approach new loans, and equip you with practical strategies to secure a resilient financial future.

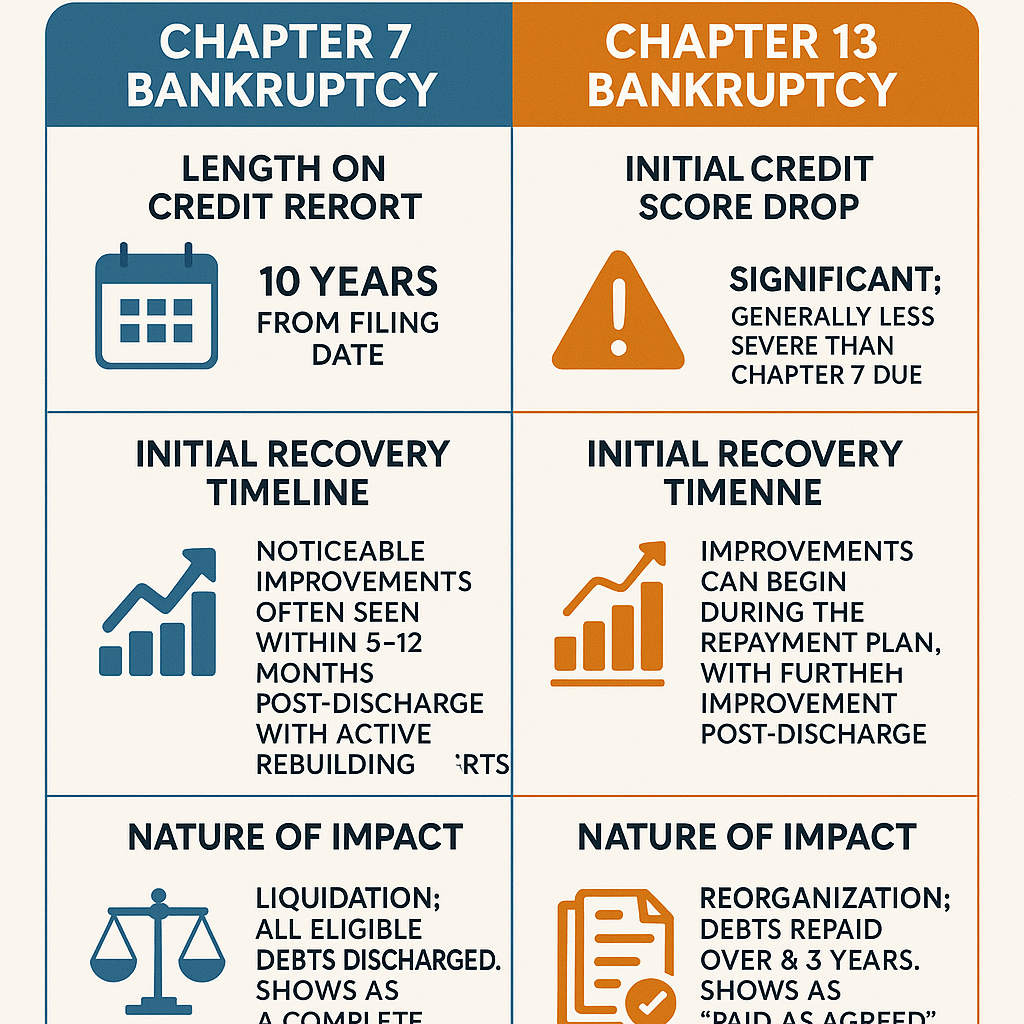

Your Post-Bankruptcy Landscape: Chapter 7 vs. Chapter 13

Understanding the specific nuances of how Chapter 7 and Chapter 13 bankruptcies impact your credit report and future opportunities is the first critical step in your rebuilding journey.

While both offer a fresh start, their long-term effects on your financial profile differ significantly.

Credit Report Impact & Timelines

The reason Chapter 13 can lead to faster credit improvement is rooted in its structure.

Unlike Chapter 7, which involves liquidating non-exempt assets and discharging debts, Chapter 13 requires you to make consistent, on-time payments to creditors over a court-approved repayment plan.

This demonstrated history of responsible payments, even within bankruptcy, can signal a more stable financial behavior to future lenders, potentially leading to better credit outcomes sooner than Chapter 7.

Asset Implications and Future Opportunities

While our focus here is on credit and future finance, it’s worth a quick note on how assets were handled. In Chapter 7, non-exempt assets are typically liquidated to pay creditors.

In Chapter 13, you retain your assets, but your repayment plan is structured around your ability to pay your debts over time.

This difference in asset handling, while significant during the bankruptcy process itself, also sets the stage for how you approach rebuilding your assets and investments in the future.

Both paths, however, lead to the same goal: a fresh financial start and the opportunity to rebuild.

Rebuilding Your Credit: A Strategic Roadmap

Rebuilding your credit isn’t about magic; it’s about consistent, strategic action.

This roadmap provides the proven steps you need to repair your credit and lay a solid foundation for your financial future.

The Power of Positive Payment History

This is the cornerstone of credit rebuilding.

Once your bankruptcy is discharged, every single on-time payment you make to new creditors contributes positively to your credit score.

Late payments, conversely, can severely set back your progress.

Treat every new credit account, no matter how small, as an opportunity to demonstrate financial responsibility.

Foundational Tools for Credit Repair

To establish a new positive payment history, you’ll need new lines of credit. Here are the most effective tools:

- Secured Credit Cards: These cards require a cash deposit, which often acts as your credit limit. They are an excellent way to start because approval is nearly guaranteed, and they report your payment activity to credit bureaus. Use them for small, recurring purchases you can immediately pay off in full each month.

- Credit-Builder Loans: Offered by credit unions or community banks, these loans work in reverse. You make payments into an account, and once the loan is fully paid, the money is released to you. Your on-time payments are reported to credit bureaus, building positive history.

- Authorized User Status: If you have a trusted friend or family member with excellent credit, they might add you as an authorized user on one of their credit cards. Their positive payment history can then appear on your report, helping your score. However, ensure they maintain excellent payment habits, as their missteps could impact you negatively.

Advanced Credit Report Accuracy: Your Personal Audit

Your credit report is your financial resume, and ensuring its accuracy post-bankruptcy is paramount. Errors are surprisingly common and can hinder your recovery.

Pull All Three Reports, Weekly, for Free: You are entitled to a free copy of your credit report from each of the three major bureaus annually via annualcreditreport.com.

Post-bankruptcy, check them frequently. You can pull one report from a different bureau every four months to monitor changes throughout the year. As of this year, you can check all three weekly for free.

Common Errors to Look For:

- Discharged Debts Still Showing Balances: All debts discharged in your bankruptcy should show a zero balance and be marked “discharged in bankruptcy” or “included in bankruptcy.”

- Incorrect Dates: Ensure the bankruptcy filing date and discharge date are accurate.

- Mixed Files: Sometimes information belonging to someone else with a similar name ends up on your report.

- Reaffirmation Agreements: If you reaffirmed a debt (like a car loan or mortgage), ensure it’s accurately reported as an ongoing account, not discharged.

- Detailed Guide to Disputing Errors Effectively: The Fair Credit Reporting Act (FCRA) is your ally .

- Identify the Error: Circle or highlight the inaccurate information.

- Gather Evidence: Collect any documents supporting your claim (e.g., bankruptcy discharge papers, court orders).

- Send a Dispute Letter: Mail a dispute letter, with copies of your evidence, to the credit bureau and the creditor reporting the incorrect information. Send via certified mail with return receipt requested for proof.

- Follow Up: Credit bureaus generally have 30 days to investigate your dispute. Be persistent and follow up if you don’t hear back.

Ensuring Accounts are Marked “Discharged in Bankruptcy”: This is crucial. If old debts are still showing as active or delinquent rather than discharged, they can continue to drag down your score and inaccurately portray your financial situation.

Obtaining New Loans Post-Bankruptcy: Cars, Homes & Beyond

A common misconception is that you’ll never get a significant loan after bankruptcy.

While it presents challenges, securing new financing for major purchases like cars and homes is absolutely possible with patience and strategic planning.

Navigating Auto Loans After Bankruptcy

Timelines: It’s technically possible to get an auto loan immediately after your bankruptcy discharge. However, the interest rates will be very high (e.g., subprime new car rates averaging 15.81%, used at 21.58%). Waiting 6-12 months and actively rebuilding your credit can significantly improve the terms and lower your interest rates.

Lender Types: You’ll likely start with subprime lenders or dealerships specializing in bad credit loans. Credit unions can also be a good option, as they sometimes offer more flexible terms to members. Focus on a lender that reports to all three credit bureaus.

Decision Factors:

Down Payment: A larger down payment reduces the loan amount and shows the lender you have skin in the game, often leading to better terms [6].

- Lower-Priced Vehicles: Start with a more affordable car to minimize your loan amount and payment. This reduces risk for both you and the lender.

- Higher Initial Interest Rates: Expect higher rates initially. The key is to make consistent, on-time payments.

- Strategy of Refinancing Later: After 6-12 months of on-time payments, and with an improved credit score, you can often refinance the loan for a lower interest rate, saving you thousands over the life of the loan [19].

Chapter 13 Nuance: Court/Trustee Approval: If you are still in your Chapter 13 repayment plan, you cannot take on new debt, including a car loan, without prior court and trustee approval [7].

Your attorney can guide you through this process, which usually involves demonstrating a clear need and showing that the new payment fits within your budget.

Securing a Mortgage Post-Bankruptcy

Buying a home after bankruptcy requires patience, but it’s a very achievable goal.

Conventional, FHA, VA Loan Waiting Periods:

Chapter 7:

- Conventional Loan: Typically a 4-year waiting period from the bankruptcy discharge date [19].

- FHA Loan: Generally a 2-year waiting period from the discharge date [19].

- VA Loan: Often only a 2-year waiting period from the discharge date, though sometimes 1 year with extenuating circumstances [19].

Chapter 13:

- Conventional Loan: Typically a 4-year waiting period from the dismissal date OR 2 years from the discharge date [19].

- FHA Loan: Often requires only 1 year of on-time payments within the repayment plan, and then discharge, demonstrating reliable payments [19].

- VA Loan: Similar to FHA, can be as little as 1 year into a repayment plan with trustee approval [19].

- Eligibility Factors: Beyond waiting periods, lenders will assess your:

- Credit Score Benchmarks: You’ll need to demonstrate substantial credit rebuilding.

- Income Stability: Lenders want to see consistent, reliable income.

Debt-to-Income (DTI) Ratio: This measures how much of your gross monthly income goes to debt payments. A lower DTI is always better.

Refinancing Options: If you already own a home or secure a mortgage with less favorable terms post-bankruptcy, refinancing later can be a smart move.

Once your credit score improves significantly and you meet the waiting periods, you can often refinance for a lower interest rate, potentially reducing your monthly payments and overall interest paid [19].

- Building a Resilient Financial Future: Beyond Credit Scores

- While credit scores are important, true financial health extends far beyond that three-digit number.

Building a resilient financial future means cultivating responsible habits and strategic planning.

Mastering Your Budget

Budgeting isn’t about deprivation; it’s about control and intentional spending. Beyond basic budgeting, consider these adaptive strategies:

- Adaptive Budgeting: Regularly review and adjust your budget as your income, expenses, or financial goals change.

- Zero-Based Budgeting: Every dollar of income is assigned a “job” (spending, saving, debt repayment). This ensures no money is left unaccounted for.

- “Pay Yourself First” Strategies: Prioritize saving and debt repayment (beyond minimums) at the beginning of each pay cycle, before allocating funds for discretionary spending.

Emergency Fund Fundamentals

An emergency fund is your safety net, preventing you from falling back into debt when unexpected expenses arise.

Why It’s Critical: It absorbs financial shocks like medical emergencies, car repairs, or job loss, without forcing you to rely on high-interest credit or loans.

Realistic Savings Goals: Start small. Aim to save $500-$1,000 as a first step. Then, gradually build up to 3-6 months’ worth of living expenses. Consistent, small contributions add up.

Avoiding Financial Pitfalls

Post-bankruptcy, you’re a prime target for predatory lenders. Be vigilant.

Spotting Predatory Loans: Beware of extremely high interest rates, hidden fees, aggressive marketing, and lenders who don’t care about your ability to repay.

High-Interest Debt Traps: Avoid payday loans, title loans, and high-interest credit cards that can quickly spiral into unmanageable debt. If an offer seems too good to be true, it likely is.

The Proven Impact of Financial Literacy & Counseling

Educating yourself about personal finance can have a profound impact on your long-term success.

Studies empirically link financial literacy and credit counseling programs to improved outcomes, including reduced debt and better delinquency metrics, even after bankruptcy [4, 21].

- Seek Certified Credit Counselors: Non-profit credit counseling agencies can help you create a realistic budget, understand credit reports, and develop a debt management plan if needed. Look for those certified by the National Foundation for Credit Counseling (NFCC).

- Setting Long-Term Financial Goals

Once you’ve stabilized your immediate financial situation, start looking further down the road.

- Retirement Savings: Even small, consistent contributions can grow significantly over time thanks to compounding interest.

- College Savings: If applicable, consider 529 plans or other educational savings vehicles.

- Future Investments: Explore low-cost index funds or other diversified investment strategies as your financial stability grows.

The Emotional & Psychological Journey of Recovery

Bankruptcy is not just a financial process; it’s a deeply emotional one. It’s common to experience stress, shame, or fear of relapse [14].

Acknowledging and addressing these feelings is as crucial to your recovery as any financial strategy.

Give yourself permission to feel these emotions, but don’t let them define your future.

Focus on small wins, celebrate your progress, and remind yourself that you are actively taking control of your financial destiny.

Building self-compassion is vital. If needed, consider seeking support from therapists, support groups, or trusted financial advisors who understand the psychological toll of financial hardship. Your resilience is one of your greatest assets.

Emerging Trends in Post-Bankruptcy Financial Recovery

The financial landscape is constantly evolving, and new tools and approaches can further aid your recovery journey.

- Simplified Bankruptcy Processes: For small business owners, the introduction of Subchapter V of Chapter 11 bankruptcy offers a more streamlined, cost-effective reorganization path. While it’s a business bankruptcy, insights from its flexibility might influence future personal insolvency considerations, especially for those whose personal finances are intertwined with their business [17].

- Role of AI/Fintech Tools: Artificial intelligence and financial technology (fintech) are revolutionizing personal finance management. AI-driven budgeting apps, automated savings tools, and personalized financial insights can help you stick to your plan, identify spending patterns, and manage your money more efficiently post-bankruptcy [17]. Leveraging these tools can significantly streamline your rebuilding efforts.

Frequently Asked Questions About Post-Bankruptcy Life

Q: How quickly can I improve my credit after bankruptcy?

A: While the bankruptcy stays on your report for 7-10 years, significant credit improvement can begin surprisingly quickly. With active rebuilding efforts (on-time payments, secured cards), initial improvements are often seen within 6-12 months post-Chapter 7 discharge, and noticeable improvement for Chapter 13 filers can occur within 12-18 months of consistent plan payments [3, 5].

Q: Can I get a credit card right after bankruptcy?

A: Yes, but typically you’ll start with a secured credit card. These require a deposit and are designed specifically for rebuilding credit. After 6-12 months of responsible use, you may qualify for an unsecured card with a low credit limit [3, 12].

Q: Will bankruptcy prevent me from buying a home forever?

A: Absolutely not. While there are waiting periods (2-4 years depending on the chapter and loan type like FHA, VA, Conventional), millions of people successfully purchase homes after bankruptcy [19]. The key is to demonstrate stable income, a low debt-to-income ratio, and consistent credit rebuilding.

Q: What’s the biggest difference for my credit between Chapter 7 and 13?

A: The most significant difference is how long the bankruptcy record remains on your credit report (10 years for Chapter 7 from filing date, 7 years for Chapter 13 from filing date) [1, 15]. Additionally, Chapter 13’s repayment plan, if followed diligently, can sometimes lead to faster credit recovery due to the consistent payments demonstrating financial responsibility [16].

Q: What should I do immediately after discharge?

A: Your immediate steps should include: pulling all three credit reports to verify accuracy, setting up a realistic budget, establishing an emergency fund, and applying for foundational credit-building tools like a secured credit card or a credit-builder loan [20].

Your Path Forward with Gort Law P.A.

Rebuilding your financial future after bankruptcy is a marathon, not a sprint. It demands patience, diligence, and a clear strategy. But with the right approach, informed decisions, and perhaps some professional guidance, you are absolutely in control of your financial comeback. At Gort Law P.A., we understand that navigating complex financial situations requires not just legal expertise, but also a deep understanding of practical business realities. Attorney Michael A. Gort’s extensive experience as an investment banker, consultant, and executive, combined with his legal acumen, means we offer personalized solutions that go beyond legal theory. We help clients achieve a fresh financial start and build a foundation for long-term stability.

If you’re ready to take the next step in securing your financial future, we’re here to help. We offer a Free Initial Consultation to discuss your unique situation and provide the tailored advice you need. Let us be your trusted advisor in this crucial phase of your financial journey.