The decision to file for bankruptcy is rarely easy. It’s often a last resort, made under immense financial strain. Once the process is complete, a common question echoes in the minds of many Floridians: “What now? Is my credit truly ruined forever? Can I ever get back on my feet?” It’s a natural concern, and a significant one. Many people believe that bankruptcy marks the end of their financial well-being, but this couldn’t be further from the truth. At Gort Law P.A., we understand that bankruptcy is, in fact, a powerful legal tool designed to give you a fresh financial start. It’s a reset button, not a stop sign. And with the right strategies, you can absolutely rebuild your credit and establish lasting financial stability here in Florida. This guide is designed to be your trusted roadmap, demystifying the post-bankruptcy journey and empowering you with the knowledge to navigate it successfully.

We’ll break down the practical steps, the timelines, and the specific considerations for those of us living in the Sunshine State, helping you move forward with confidence.

Understanding Your Credit Score Post-Bankruptcy: The “Why” and “How”

The first step in rebuilding is understanding exactly what happened to your credit and how the system works. Filing for bankruptcy will impact your credit score, but perhaps not in the way you expect, and certainly not permanently.

The Immediate Impact and the “K-Shaped” Recovery

Here’s a crucial insight: the immediate impact of bankruptcy on your credit score can vary significantly based on your financial health before filing.

- For those with deep subprime scores (below 580) pre-bankruptcy, the act of filing and discharging debt often leads to an immediate increase in their credit score. Data from LendingTree (March 2025) indicates an average increase of approximately 88.6 points one month after filing for consumers in this category. Why? Because the bankruptcy zeroes out delinquent accounts, removing the most severe negative factors dragging their scores down.

- For those with higher pre-filing scores (e.g., prime, 660-719), an initial drop is more likely, potentially around 35.8 points (Equifax, May 2025). Their scores have further to fall, but the path to recovery is often quicker if they adopt diligent rebuilding strategies.

This creates a “K-shaped” recovery landscape, where the starting point influences the initial trajectory.

Regardless of your starting score, the key takeaway is that recovery is not just possible but often begins almost immediately.

How Bankruptcy Appears on Your Credit Report

A Chapter 7 bankruptcy typically remains on your credit report for 10 years from the filing date, while a Chapter 13 bankruptcy remains for 7 years (Bankrate, Upsolve, Experian).

While these entries are long-lasting, their negative impact diminishes significantly over time.

Credit scoring models give less weight to older derogatory information, emphasizing your recent financial behavior.

This means your score can begin to improve much sooner than the removal date.

The Mechanics of Credit Scoring Models: FICO vs. VantageScore

To effectively rebuild, you need to know what credit scoring models, like FICO and VantageScore, prioritize.

Both models emphasize similar factors, though their exact weighting can differ slightly:

- Payment History (around 35% of your FICO score): This is the single most important factor. Consistent, on-time payments are paramount. Every payment made on time after bankruptcy helps to counteract the negative impact of past delinquencies (mydaytonaattorney.com).

- Amounts Owed/Credit Utilization (around 30%): How much credit you’re using compared to your available credit limits. Keeping your utilization low (ideally below 30% for each card and overall) is crucial.

- Length of Credit History (around 15%): The older your accounts, the better. While bankruptcy wipes out many old accounts, those that remain (like a reaffirmed mortgage or student loan) can still contribute positively.

- New Credit (around 10%): How many new accounts you’ve opened recently. Too many in a short period can be seen as risky.

- Credit Mix (around 10%): Having a healthy mix of different credit types (e.g., installment loans like auto loans, and revolving credit like credit cards) can be beneficial (FDIC, CGAP Technical Guide).

The good news is that after bankruptcy, your “amounts owed” are often reset to zero, which can significantly boost that segment of your score as you begin to take on new, small, manageable debts.

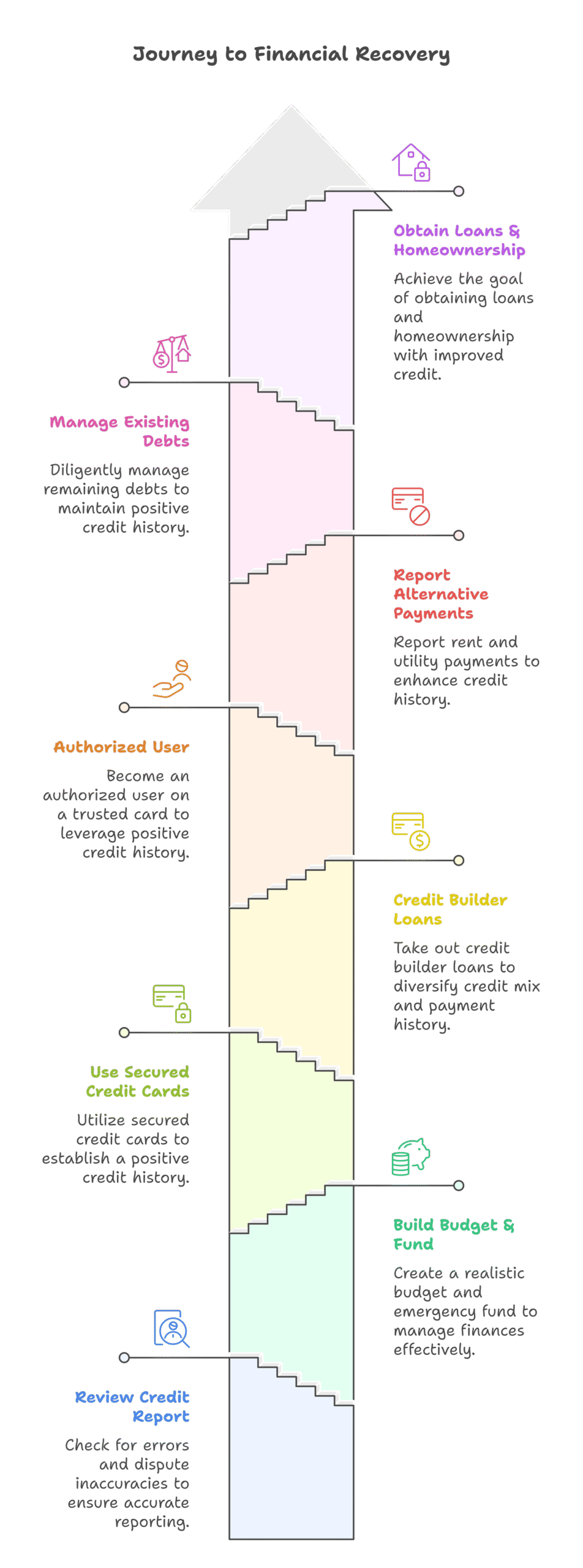

Phase 1: Immediate Steps Post-Discharge (First 3-6 Months)

The moment your bankruptcy is discharged, you’re ready to act. These initial steps are critical for setting the foundation for your credit rebuilding journey.

1. Review and Dispute Credit Report Errors

This is your absolute first and most critical step. After discharge, contact all three major credit bureaus (Experian, Equifax, and TransUnion) to obtain a free copy of your credit report. You are entitled to one free report from each bureau annually via AnnualCreditReport.com.

- Scrutinize every entry: Ensure all debts included in your bankruptcy are accurately reported with a “$0 balance” or “discharged in bankruptcy” status.

- Dispute inaccuracies: If you find errors, dispute them immediately with the credit bureau. This can significantly impact your score and prevent future headaches.

2. Financial Triage: Building Your Budget and Emergency Fund

With old debts cleared, you have a unique opportunity to reset your financial habits.

- Create a realistic budget: This isn’t about deprivation; it’s about understanding where your money goes and taking control. Account for essential living expenses specific to Florida’s cost of living, from housing to transportation and groceries.

- Build a small emergency fund: Even a few hundred dollars can prevent minor financial setbacks from turning into major crises. Start small – perhaps $500 to $1,000 – as a buffer. Upsolve.org emphasizes the importance of budgeting and emergency funds as pillars of post-bankruptcy financial stability.

3. Secured Credit Cards for Quick Wins

This is often the fastest and most effective way to begin building new, positive credit history.

- How they work: You provide a deposit (e.g., $200-$500), and that deposit becomes your credit limit. You use the card like a regular credit card, making small purchases and paying them off in full and on time every month.

- Why they’re effective: Lenders report your payment activity to the credit bureaus. Since your deposit mitigates their risk, secured cards are much easier to obtain post-bankruptcy. Look for cards with low annual fees and those that report to all three major credit bureaus. Many Florida credit unions and community banks offer competitive secured card options.

Phase 2: Building Momentum: Strategic Credit Rebuilding (6-24 Months)

Once you’ve established initial positive habits, it’s time to strategically expand your credit profile.

1. Strategic Use of Credit Builder Loans

These are loans specifically designed to help you build credit.

- How they work: You borrow a small amount (e.g., $500-$1,000), but instead of receiving the money upfront, it’s held in an interest-bearing account (CD or savings). You make monthly payments, which are reported to credit bureaus. Once the loan is paid off, you receive the full amount plus interest.

- Benefits: They contribute to your payment history and diversify your credit mix by adding an installment loan to your profile. Many credit unions in Florida offer these products.

2. Becoming an Authorized User

If you have a trusted friend or family member with excellent credit, they might consider adding you as an authorized user on one of their credit cards.

- Pros: Their positive payment history and low utilization can appear on your credit report, potentially boosting your score.

- Cons & Caveats: Ensure the primary cardholder has a perfect payment history and keeps their utilization low. You should not rely on this as your sole credit-building strategy, and you are not legally responsible for the debt.

3. Reporting Alternative Payments

Some services can help report payments not traditionally included in credit reports, giving you an extra boost.

- Rent and Utilities: Services like Experian Boost, Rental Kharma, or LevelCredit can report your on-time rent, utility, and cell phone payments to credit bureaus. This is particularly valuable for establishing a payment history when you have limited traditional credit. Upsolve.org highlights reporting rent and utilities as a smart, often overlooked strategy.

4. Managing Existing Debts (If Any Remain)

Not all debts are discharged in bankruptcy. Student loans, certain tax debts, and reaffirmed secured debts (like a car loan or mortgage you chose to keep and continue paying) often remain.

- Reaffirmed Debts: If you reaffirmed a car loan or mortgage during your bankruptcy, maintaining on-time payments is absolutely critical. These payments will build positive credit history directly.

- Student Loans/Tax Debts: While often not discharged, you may have new payment arrangements. Ensure these are met diligently. If you need assistance navigating legal issues that arise from these, remember that Gort Law P.A. offers comprehensive civil litigation support for various disputes that may arise.

Phase 3: Major Milestones – Loans & Homeownership in Florida (2+ Years)

As your credit score steadily improves, you’ll start qualifying for more significant financial products.

Obtaining New Loans: Auto and Personal

- Car Loans: Lenders are often more willing to issue car loans sooner after bankruptcy than mortgages, particularly if you have stable employment and have demonstrated consistent payments on secured cards or credit builder loans. Expect a higher interest rate initially, but focus on on-time payments. After 12-24 months of perfect payments, you may be able to refinance at a lower rate.

- Personal Loans: These can be used to consolidate higher-interest debts (if any remain) or for specific needs. As with auto loans, rates will be higher post-bankruptcy, so ensure the payments are manageable.

Understanding Mortgage Eligibility in Florida

Buying a home after bankruptcy is a significant goal for many Floridians, and it is entirely achievable.

Florida’s vibrant real estate market also offers unique advantages, like the homestead exemption, which can protect your primary residence in future financial difficulties.

For more detailed information on local real estate, you can explore Gort Law P.A.’s Florida real estate insights.

Here are the typical waiting periods for various loan types after bankruptcy discharge:

- FHA Loans (Federal Housing Administration):

- Chapter 7: Typically requires a 2-year waiting period after discharge. You’ll need to demonstrate stable employment and re-established credit.

- Chapter 13: Generally requires at least 1 year of on-time plan payments, and court permission to incur new debt. The loan must be closed before discharge, or a 2-year waiting period applies after discharge (miamibankruptcy.com).

- VA Loans (Veterans Affairs):

- Chapter 7: Typically a 2-year waiting period after discharge.

- Chapter 13: Usually a 1-year waiting period after starting your payment plan, with court approval.

- USDA Loans (United States Department of Agriculture):

- Chapter 7: Generally a 3-year waiting period after discharge.

- Chapter 13: Often a 1-year waiting period after consistent payments, with court approval.

- Conventional Loans (Fannie Mae/Freddie Mac):

- Chapter 7: Typically requires a 4-year waiting period after discharge.

- Chapter 13: Usually requires a 2-year waiting period after discharge (miamibankruptcy.com). Some lenders may consider 1-year after filing with consistent payments.

Navigating Lender Expectations in Florida

Beyond waiting periods and credit scores, Florida lenders will look at several factors:

- Stable Employment: Demonstrating a consistent income is crucial. Lenders want to see you’ve been at your current job for at least two years (gallowaylawoffices.com).

- Debt-to-Income (DTI) Ratio: Even with a cleared slate, new debts (like a car loan or credit card balances) will contribute to your DTI. Lenders prefer lower DTI ratios.

- Savings and Down Payment: A strong savings history and a down payment (even a small one for FHA) show financial discipline.

Long-Term Financial Stability & Wealth Building in Jupiter, FL

Rebuilding credit is just one piece of the puzzle. True financial stability comes from adopting sound money management principles for the long haul.

Advanced Budgeting & Savings Strategies

Move beyond basic budgeting to strategic financial planning:

- Automate Savings: Set up automatic transfers to savings accounts for various goals – emergency fund, down payment, retirement.

- Save for Retirement: Even small, consistent contributions to a 401(k) or IRA can add up significantly over time.

- Consider Investment: Once stable, explore low-cost index funds or other investments to grow your wealth.

- Estate Planning: As your assets grow, protect your legacy. Gort Law P.A. also provides comprehensive probate and estate planning services to help you secure your future and your loved ones’.

Protecting Your “New” Credit

- Avoid Common Pitfalls: Don’t fall back into old habits. Avoid taking on more debt than you can comfortably repay.

- Monitor Your Credit Regularly: Keep an eye on your credit reports for any suspicious activity or errors.

- Identity Theft Protection: Consider services that monitor for identity theft, especially given the prevalence of digital transactions.

The Emotional Journey: Persistence and Positivity

Bankruptcy can be emotionally taxing. It’s okay to acknowledge the challenges you’ve faced.

But remember, you’ve taken control, made a difficult decision, and are actively working towards a brighter financial future.

Celebrate your small victories, stay persistent, and understand that financial recovery is a marathon, not a sprint. Your dedication to a fresh start is your most powerful asset.

Florida Resources & Professional Guidance

While this guide provides a comprehensive overview, navigating your post-bankruptcy financial life can still feel complex. Here are some resources for Floridians:

- Non-Profit Credit Counseling Agencies: Many accredited non-profit organizations in Florida offer free or low-cost credit counseling and debt management plans. They can provide personalized budgeting advice and help you navigate credit rebuilding resources. The National Foundation for Credit Counseling (NFCC) offers a directory.

- Florida Financial Advisors: For more advanced financial planning, especially as you begin to consider investments or complex asset protection, a fee-only financial advisor can provide tailored guidance.

- Your Florida Bankruptcy Attorney: While your bankruptcy attorney’s primary role is the filing process, they remain a valuable resource for understanding the legal implications of your discharge, especially regarding property, liens, and future legal questions. If you are considering or have recently completed bankruptcy, our team at Gort Law P.A. specializes in Gort Law P.A.’s bankruptcy services, offering personalized guidance for a fresh start. Whether you’re interested in understanding Chapter 7 bankruptcy or exploring Chapter 13 bankruptcy, we’re here to help.

Frequently Asked Questions About Life After Bankruptcy

Q1: How quickly can my credit score improve after bankruptcy in Florida?

A1: Improvement can begin surprisingly quickly. For those with very low scores pre-filing, an immediate increase of nearly 90 points is possible within a month. For others, consistent positive financial behavior (on-time payments, low credit utilization) can lead to significant improvements within 12-24 months, even while the bankruptcy remains on your report. The key is consistent, disciplined action.

Q2: Can I get a car loan or personal loan immediately after bankruptcy discharge in Florida?

A2: It’s challenging but possible. Some lenders specialize in post-bankruptcy loans, but you’ll likely face higher interest rates. It’s generally advisable to wait 6-12 months and build a positive payment history with a secured credit card or credit builder loan first. This will demonstrate new financial responsibility and help you qualify for better terms.

Q3: Will bankruptcy prevent me from buying a home in Florida forever?

A3: Absolutely not. You can purchase a home after bankruptcy. As detailed above, there are specific waiting periods (2-4 years typically) for FHA, VA, USDA, and Conventional loans after your discharge, depending on the type of bankruptcy and loan. With stable employment, a reasonable debt-to-income ratio, and consistent credit rebuilding efforts, homeownership is an achievable goal in Florida.

Q4: How do credit builder loans and secured credit cards help differently?

A4: Both are excellent tools. A secured credit card helps you build revolving credit history (like a traditional credit card) and establish a low credit utilization ratio. A credit builder loan helps establish an installment loan history and shows your ability to make consistent payments on a fixed debt, diversifying your credit mix. Using both can accelerate your rebuilding process.

Q5: What if I have student loans or tax debts that weren’t discharged?

A5: Student loans and most tax debts are generally not dischargeable in bankruptcy. It’s crucial to understand your repayment obligations for these. Work with your lenders or the IRS to establish affordable payment plans. Consistent, on-time payments on these remaining debts will also positively impact your credit score.

Your Path to a Stronger Financial Future Starts Now

Bankruptcy is not the end; it’s a strategic turning point. It’s an opportunity for a fresh start, allowing you to shed overwhelming debt and begin anew with invaluable lessons learned. Your journey to rebuilding credit and achieving lasting financial stability in Florida is entirely within reach. At Gort Law P.A., we don’t just guide you through the bankruptcy process; we empower you for life after it. Attorney Michael A. Gort’s unique blend of legal expertise and extensive business background means we approach your financial future with a comprehensive understanding that few other firms can match. We’re committed to providing the personalized service and authoritative guidance you need to navigate these waters with confidence.

If you have questions about your post-bankruptcy financial life, or if you’re exploring bankruptcy as a path to a fresh start, we invite you to connect with us. Take the first step towards a more secure financial future.