Imagine feeling like you’re constantly swimming upstream, battling the tide of rising living costs while your home – once a symbol of security – now feels like a financial anchor. For many homeowners in Florida, a second mortgage or Home Equity Line of Credit (HELOC) taken out years ago, perhaps when property values were booming, has become just that. As home values fluctuated, many homeowners countless properties found themselves “underwater,” meaning theyyou owe more on theiryour first mortgages than their your home is currently worth.

This can feel like an impossible situation, especially if you’re struggling to keep up with payments. You might wonder if there’s any way out, a lifeline that could ease the burden of that second lien. While it’s true that bankruptcy can offer relief, many people don’t realize that one specific type – Chapter 13 bankruptcy – offers a powerful tool called “lien stripping” that could potentially eliminate your second mortgage or HELOC altogether if the value of the home is less than the amount outstanding on the first mortgage.

This isn’t about magical thinking; it’s a specific legal process designed to help homeowners regain control. Let’s explore how lien stripping works in Florida, why Chapter 13 is your best path, and what it could mean for your financial future.

Understanding Liens and How Your Home Can Be “Underwater”

Before we dive into lien stripping, let’s get clear on a few foundational concepts.

What is a Lien?

Think of a “lien” as a legal claim against your property. It’s like a promise you make to a lender: “If I don’t pay you back, you have the right to take possession of this asset (my home) to recover what I owe.” Although Florida homes are usually protected by the Constitutional homestead provisions, mortgages are usually the exception that proves the rule.

- First Mortgage: This is typically your primary home loan. It’s the “senior” lien because it was recorded first and has priority. If your home were to be sold (e.g., in a foreclosure), the first mortgage lender would get paid back first.

- Second Mortgage/HELOC (Junior Liens): These are loans taken out after your first mortgage, using your home as collateral. They are “junior” liens, meaning they get paid in a foreclosure only after the first mortgage lender is fully satisfied. A Home Equity Line of Credit (HELOC) functions very similarly to a second mortgage in this context, as it’s also secured by your home’s equity. Other junior liens can include judgment liens (which usually do not defeat homestead protection), tax liens (though these often have unique rules), andor even some homeowners association (HOA) liens.

The “Underwater” Problem

The concept of being “underwater” (or “upside down”) on your home is central to lien stripping. This occurs when the outstanding balance on your first mortgage is equal to or greater than the current market value of your home.

For example:

- Your Home’s Current Value: $250,000

- Your First Mortgage Balance: $280,000

- Your Second Mortgage/HELOC Balance: $50,000

In this scenario, your Second Mortgage/HELOC home is “underwater” by $30,000 ($280,000 – $250,000).

Because the first mortgage already exceeds the home’s value, there’s literally no equity left to secure the second mortgage or HELOC.

From a legal standpoint, the second lien is considered “wholly unsecured.”

This situation, unfortunately, became common for many Florida homeowners following the real estate downturns of the past. It creates the perfect storm for considering lien stripping.

What Exactly is Lien Stripping in Chapter 13 Bankruptcy?

Lien stripping is a powerful legal tool available only in Chapter 13 bankruptcy that allows you to reclassify a junior mortgage lien (like a second mortgage or HELOC) from a secured debt to an unsecured debt.

The Golden Rule of Eligibility: When a Junior Lien is “Wholly Unsecured”

The key to lien stripping is the “wholly unsecured” rule, which stems from Section 506(a) of the Bankruptcy Code. A junior lien can only be stripped if it is completely unsecured by any equity in the property.

This means that the outstanding balance on your first mortgage must be more than the current fair market value of your home. If there’s even one dollar of equity remaining after accounting for the first mortgage, the second mortgage or HELOC cannot be “stripped.”

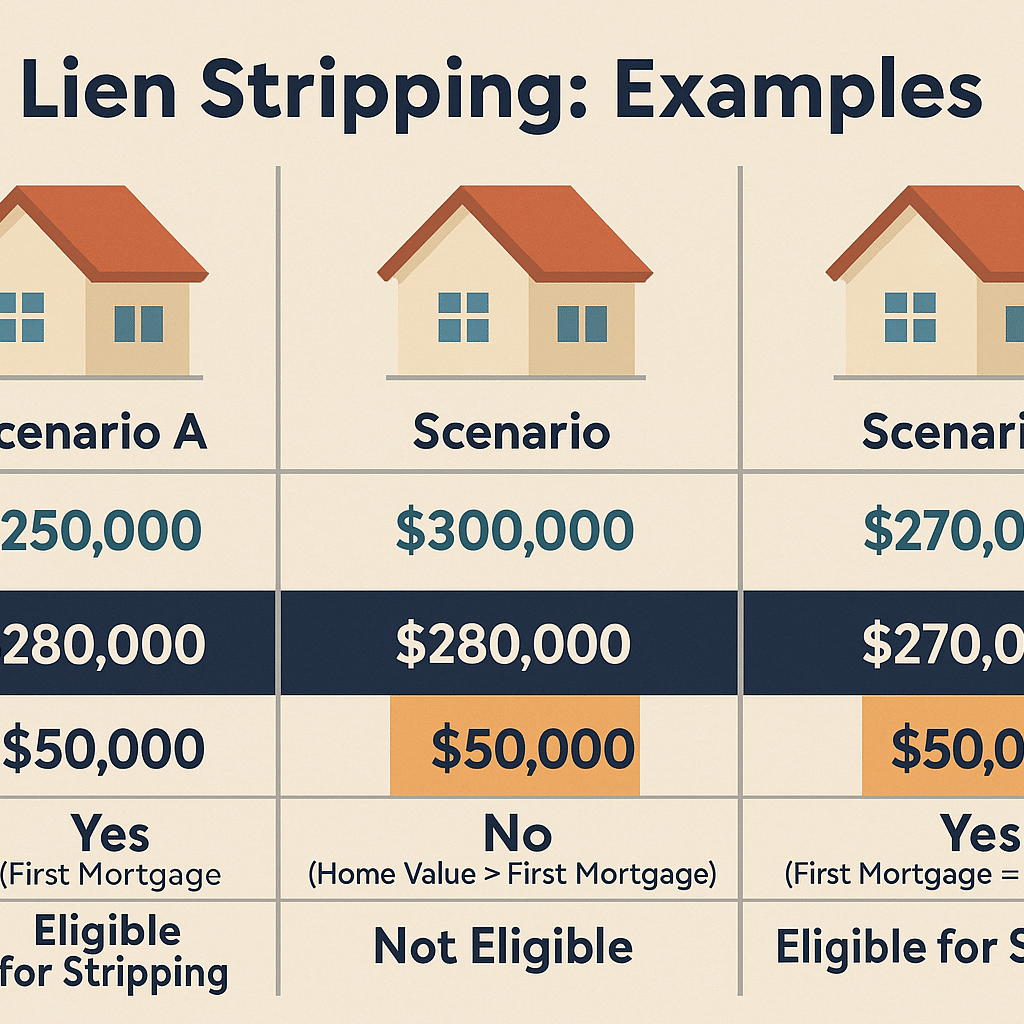

Let’s look at examples:

In scenarios A and C, because the entire value of the home is consumed by the first mortgage (or the first mortgage balance even exceeds the home’s value), the second mortgage has nothing to “attach” to in terms of equity. It is therefore considered “wholly unsecured” and can be stripped.

What Does “Stripping” Really Mean?

The process for stripping wholly unsecured mortgage liens varies among the Northern, Middle, and Southern Districts. In all three districts, the debtor must file a motion to determine the status of the lien. If the court approves your lien strip, that second mortgage or HELOC is no longer treated as a secured debt. Instead, it’s reclassified as an unsecured debt, similar to credit card debt or medical bills. This debt then gets folded into your Chapter 13 repayment plan and is typically paid back at a pro rata percentage that varies based on your disposable income. Once you complete your Chapter 13 plan and receive your discharge, any unpaid portion of the second mortgage or HELOC lien is discharged (legally extinguished) along with all other remaining unsecured debt. The process in each of the three Florida Districts must be closely followed.

To remove the lien in the County’s Official Records after the Chapter 13 discharge, Florida Statutes § 55.145 provides a mechanism to remove a lien that was discharged in bankruptcy. You may also move to reopen a Chapter 13 for the purpose of obtaining an order from the bankruptcy court with the same effect as the order under Fla. Stat. § 55.105

For a deeper dive into how Chapter 13 can help with other financial challenges, explore our guide on Understanding Chapter 13 Bankruptcy (placeholder internal link).

Chapter 13 vs. Chapter 7: Why This Distinction Matters for Secured Debt

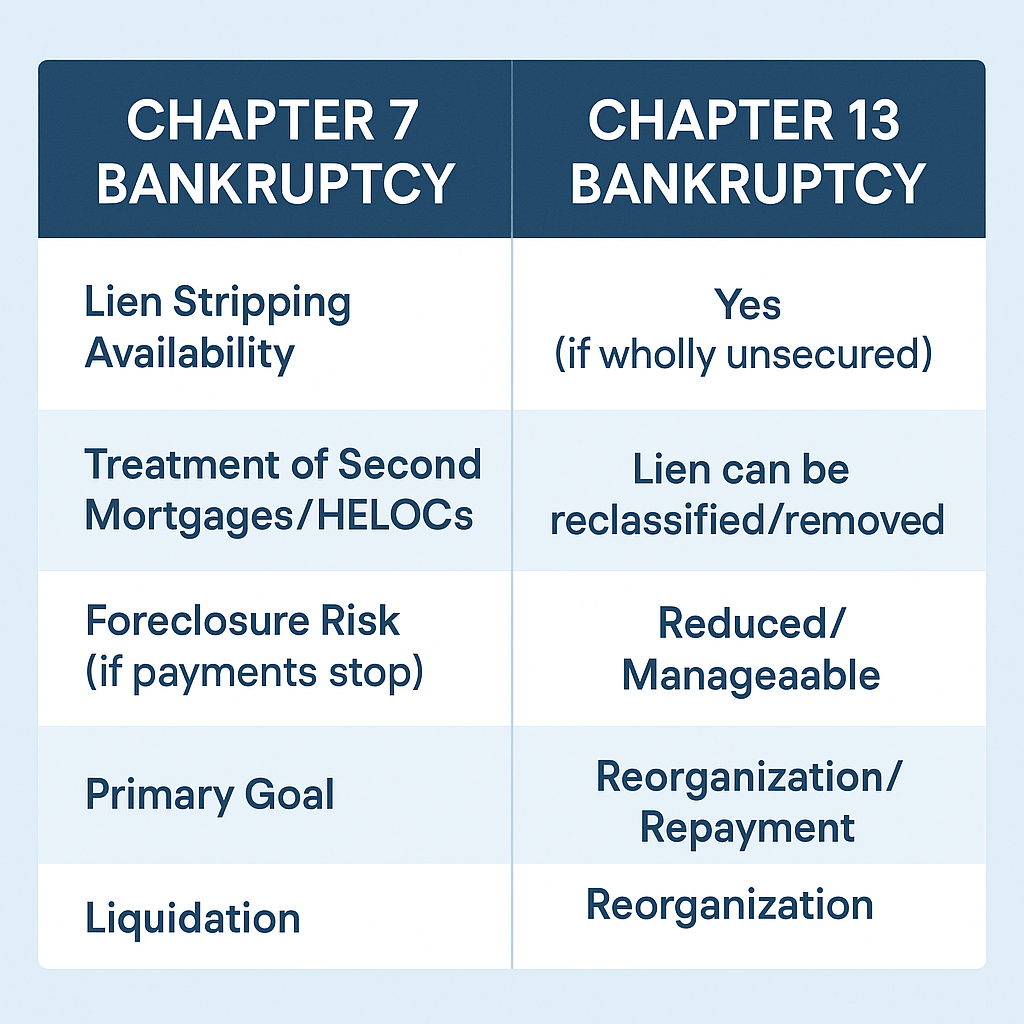

This is a critical distinction, and it’s where many people get confused. The ability to “strip” a second mortgage or HELOC lien is a unique feature of Chapter 13 bankruptcy.

Secured Debt Treatment in Chapter 7 Bankruptcy

In Chapter 7 bankruptcy (often called “liquidation” bankruptcy), you generally cannot strip away secured liens from your property. While Chapter 7 can discharge your personal obligation to pay the debt (meaning they can no longer sue you or harass you for payment), the lien itself remains attached to the property.

This means if you don’t keep up payments on a secured loan (like a mortgage), even after a Chapter 7 discharge, the lender can still pursue foreclosure on the property. Chapter 7 primarily deals with unsecured debts and allows for a fresh start by liquidating non-exempt assets, but it doesn’t generally modify or remove liens from real property. The U.S. Supreme Court case of Dewsnup v. Timm affirmed this, establishing that liens “ride through” Chapter 7 bankruptcy.

Secured Debt Treatment in Chapter 13 Bankruptcy

Chapter 13 bankruptcy (often called “reorganization” bankruptcy) is different. It allows individuals with regular income to propose a repayment plan, typically lasting three to five years, to repay all or a portion of their debts. This framework provides the flexibility needed to address secured debts in ways Chapter 7 does not.

Within Chapter 13, the ability to “strip” a lien arises because the court can “cram down” or modify certain secured claims. When a junior lien is “wholly unsecured” by any equity, the bankruptcy court can effectively reclassify it, treating it as if it were an unsecured debt within your repayment plan.

For homeowners in Florida facing foreclosure or overwhelming debt on their home, understanding this distinction is paramount. Chapter 13 offers a pathway to potentially save your home and eliminate a major debt burden that Chapter 7 cannot.

If you’re considering Chapter 7, it’s vital to understand its limitations for secured debts.

The Florida Lien Stripping Process: Your Path to a Fresh Start

While the concept of lien stripping might seem straightforward, the actual process involves several key steps within your Chapter 13 bankruptcy case. It requires careful preparation and adherence to legal procedures.

1. Initial Assessment: Valuing Your Home

The very first and most crucial step is accurately determining the current fair market value of your Florida home. This is essential to prove that your second mortgage or HELOC is “wholly unsecured.”

- Professional Appraisal: This is often the most reliable method. A licensed appraiser will evaluate your property, comparable sales, and market conditions to provide an official valuation. This document is critical evidence for the bankruptcy court.

- Broker’s Price Opinion (BPO): In some cases, a Sometimes a BPO from a real estate agent may might be used, but an appraisal carries more weight in court.

2. Filing the Chapter 13 Petition and Plan

After your home’s value is established and it’s determined that your junior lien is indeed “wholly unsecured,” you will file your Chapter 13 bankruptcy petition with the Florida bankruptcy court, which includes filing a chapter 13 plan for a three or five-year duration..

Stripping Wholly Unsecured Second Mortgage or HELOC LiensSimultaneously, or shortly thereafter, you’ll propose a detailed repayment plan outlining how you intend to pay your creditors over the next three to five years.

This plan will treat the stripped second mortgage or HELOC as an unsecured debt.

3. The Lien Strip Motion (or Adversary Proceeding)

To formally strip the lien, your attorney will file a specific motion with the bankruptcy court, often called a “Motion to Determine Secured Status” or a “Motion to Value Collateral.”

In rare some cases, depending on the court and the complexity, an adversary proceeding (essentially a lawsuit within the bankruptcy case) may might be required.

This motion clearly states that the junior lien is wholly unsecured and requests the court to reclassify it.

4. Court Hearings and Potential Objections

The lender whose lien you are attempting to strip will receive notice of your motion and has the opportunity to object.

They might challenge your home’s valuation or argue that their lien is not “wholly unsecured.”

If there’s an objection, a hearing will be scheduled where your attorney will present evidence (like your appraisal) to support your claim. The bankruptcy judge will then make a ruling.

5. Confirmation of the Chapter 13 Plan

If the court approves the lien strip motion and finds that your repayment plan meets all legal requirements, your Chapter 13 plan will be “confirmed.”

Once confirmed, the plan becomes legally binding on all parties, including the stripped lienholder.

Important Note for Florida Residents: While the overall process is federal, local court rules, judge’s preferences, and typical timelines can vary slightly between Florida’s different bankruptcy districts (e.g., Southern District, Middle District, Northern District of Florida). An experienced Florida bankruptcy attorney understands these nuances.

Navigating this process without professional guidance can be overwhelming. Learn how a Free Consultation with Gort Law P.A. (placeholder internal link) can help clarify your options.

Myth vs. Reality: Common Misconceptions About Lien Stripping

Lien stripping, while powerful, is often misunderstood. Let’s debunk some common myths:

[Image: A split screen visual with “MYTH” on one side (with a question mark or ‘X’ symbol) and “REALITY” on the other side (with a checkmark or lightbulb symbol). Arrows connect the corresponding myth and reality points.]

Myth 1: “If I have any equity, I can still strip my second mortgage.”

Reality: False. For a lien strip to occur, the junior lien must be wholly unsecured. This means the first mortgage balance must entirely consume or exceed the value of the home. If there’s even $1 of equity remaining after the first mortgage is accounted for, the lien cannot be stripped.

Myth 2: “The lien disappears immediately after the court grants the motion.”

Reality: False. While the court’s order reclassifies the debt, the lien is not officially removed from your property title until you successfully complete your Chapter 13 payment plan and receive your final bankruptcy discharge. Once the The personal obligation to pay that second mortgage or HELOC is discharged, but the lien itself must be removed by a Court Order under Florida Statutes 55.105 or an Order from the bankruptcy court after filing a motion to reopen the Chapter 13 case.remains on the property records until discharge.

Myth 3: “Lien stripping only applies to mortgages, not HELOCs or HOA liens.”

Reality: False. Lien stripping can apply to any junior lien that is wholly unsecured, including second mortgages, HELOCs, judgment liens, and in some cases, even homeowners association (HOA) liens or condominium association (COA) liens. The “wholly unsecured” rule is the determining factor.

Myth 4: “I can stop paying my first mortgage if I’m stripping my second.”

Reality: False. Lien stripping only affects junior liens. Your first mortgage remains a secured debt that you must continue to pay according to its terms (or cure any arrears through your Chapter 13 plan) if you wish to keep your home. Failing to pay your first mortgage will likely lead to foreclosure.

Myth 5: “Lien stripping is automatic in Chapter 13.”

Reality: False. It is absolutely not automatic. You (or your attorney) must actively file a specific motion or adversary proceeding with the court, provide evidence of your home’s value, and obtain a court order approving the lien strip.

Myth 6: “Florida courts rarely allow lien stripping.”

Reality: False. Lien stripping is a well-established and routinely used tool in Florida bankruptcy courts, provided the strict legal requirements (especially the “wholly unsecured” rule) are met. An experienced Florida bankruptcy attorney can guide you through the process effectively.

What Happens After Your Lien is Stripped?

Once the bankruptcy court approves your lien strip and confirms your Chapter 13 plan, the journey isn’t quite over, but the path forward becomes much clearer.

Reclassification as Unsecured Debt

The balance of your second mortgage or HELOC is now officially treated as an unsecured debt within your Chapter 13 plan. This means it’s grouped with other unsecured debts like credit cards and medical bills. The amount you pay towards these unsecured debts is determined by your disposable income and other factors in your plan. Often, unsecured creditors receive only a small percentage, or even zero, of what they are owed.

Impact on Your Chapter 13 Plan Payments

By stripping the second lien, your monthly Chapter 13 plan payments could be significantly lower than if you had to account for a secured payment on that second mortgage/HELOC. This frees up disposable income to address other necessary payments or to make your plan more manageable.

When the Lien is Legally Removed from Public Records

This is a crucial point: While the debt is reclassified and the court’s order is in place, the lien itself remains on your property’s public records until you successfully complete your Chapter 13 plan and receive your bankruptcy discharge. Only then is the lien officially extinguished and the cloud removed from your title. This typically happens 3 to 5 years after your plan is confirmed. Florida Statutes § 55.105 may only be used for one year after your discharge to satisfy a stripped mortgage. The debtor can immediately reopen the Chapter 13 case for the purpose of obtaining an order from the bankruptcy court with the same effect on the lien as an order under § 55.105.

What if Your Chapter 13 Case is Dismissed Before Completion?

This is a risk to be aware of. If your Chapter 13 case is dismissed before you receive your discharge, the lien strip will may be undone, and the second mortgage or HELOC lender could reassert their secured claim against your property, with the amount due reduced by any payments made during your bankruptcy case.. This underscores the importance of a well-structured plan and consistent payments.

Is Lien Stripping Right for Your Florida Home?

Lien stripping can be a game-changer for Florida homeowners struggling with underwater second mortgages or HELOCs. It offers a path to significant financial relief and helps you retain your home without the burden of an unmanageable debt.

Self-Assessment Questions:

- Is the balance of your first mortgage greater than the current market value of your home?

- Are you able to make regular payments towards your first mortgage (andor cure any arrears through a Chapter 13 plan)?

- Do you have a consistent income to fund a Chapter 13 repayment plan?

- Are you looking for a way to save your home and get a fresh financial start?

Required Documentation:

If you’re considering this option, start gathering:

- Your most recent first mortgage statement.

- Your most recent second mortgage or HELOC statement.

- A recent appraisal or detailed market analysis of your home.

- Documentation of your income and expenses.

Why Expert Legal Guidance is Crucial

Lien stripping is a complex legal process with precise requirements. Filing the wrong motion, failing to provide proper valuation evidence, or misunderstanding the procedural nuances can lead to delays or even denial.

An experienced Florida bankruptcy attorney, familiar with local court practices, can:

- Accurately assess your eligibility.

- Obtain a reliable appraisal.

- Prepare and file all necessary motions and documentation.

- Represent you in court and handle any objections from lenders.

- Structure your Chapter 13 plan for maximum benefit and successful completion.

Frequently Asked Questions About Lien Stripping in Jupiter, Florida Chapter 13 Bankruptcy

Q: Can I strip a first mortgage in Chapter 13?

A: No. Under current bankruptcy law, you generally cannot strip or modify a first mortgage on your primary residence through Chapter 13 bankruptcy. The ability to “strip” only applies to junior liens that are wholly unsecured.

Q: What is the “anti-modification rule”?

A: The “anti-modification rule” is a part of the Bankruptcy Code (§1322(b)(2)) that protects a mortgage lender whose loan is secured solely by your principal residence from having the terms of their loan modified (like interest rate, principal balance, or payment amount) in Chapter 13. However, this rule does not apply to wholly unsecured junior liens, which is why lien stripping is permitted.

Q: How long does the lien stripping process take?

A: The lien stripping motion is typically filed early in your Chapter 13 case. The actual approval of the motion can occur relatively quickly once the court hears it, but the official removal of the lien from your property records doesn’t happen until you successfully complete your entire Chapter 13 plan (which usually lasts 3 to 5 years) and receive your discharge.

Q: What if my home value goes up after I strip the lien?

A: The eligibility for lien stripping is based on your home’s value at the time your Chapter 13 bankruptcy petition is filed. If your home’s value increases after the lien is stripped and your plan is confirmed, it generally does not impact the prior stripping order, assuming the order was properly granted.

Q: Can I strip an HOA lien or judgment lien in Chapter 13?

A: Yes, if an HOA lien or a judgment lien is deemed “wholly unsecured” (meaning there’s no equity in the home to secure it after accounting for all senior liens like the first mortgage), it can potentially be stripped in Chapter 13 bankruptcy, similar to a second mortgage or HELOC.

Q: What if I miss payments on my Chapter 13 plan after the lien is stripped?

A: If your Chapter 13 plan is dismissed or not completed, the original lien that was stripped may “snap back” or be reinstated, and the lender could pursue their rights against the property, including foreclosure. It is crucial to successfully complete your plan to ensure the lien remains extinguished.

Take the Next Step Towards Financial Freedom

The idea of eliminating a burdensome second mortgage or HELOC can feel like a distant dream, but for many Florida homeowners, it’s a tangible reality through Chapter 13 bankruptcy and the power of lien stripping. It’s a complex process, but it offers a unique opportunity for a fresh financial start, allowing you to focus on your primary home loan and rebuild your future.

If you’re grappling with an underwater second mortgage or HELOC in Florida, you don’t have to navigate these waters alone. Understanding your options is the first step towards taking back control.

Explore a confidential consultation to discuss your specific situation and see if lien stripping is the right solution for you. Your peace of mind and financial recovery could be closer than you think