Imagine this: you’re making monthly payments on your car, but you know deep down it’s not worth what you owe. Maybe your car depreciated faster than you expected, or you bought it when interest rates were high. This feeling of being “upside-down” on a car loan can be incredibly frustrating, adding significant stress when every dollar counts.

What if there was a way to legally adjust that loan to reflect your car’s true value and even lower your interest rate, all while keeping your vehicle?

For many Floridians, Chapter 13 bankruptcy offers a powerful, often misunderstood, feature called a “cramdown” that can provide exactly this kind of relief. It’s a bit like renegotiating your car loan on your terms, guided by federal law.

What Exactly is a “Cramdown” in Chapter 13 Bankruptcy?

Think of a cramdown as a legal way to “reset” your car loan. In a Chapter 13 bankruptcy, if certain conditions are met, you can reduce the principal balance of your car loan to the actual market value of the vehicle.

Not only that, but the interest rate on the adjusted loan can often be lowered as well.

The goal? To make your car payments more manageable, reflecting what the asset is truly worth, and giving you a realistic path to financial recovery.

Chapter 13 vs. Chapter 7: Different Paths for Your Car Loan

When you’re exploring bankruptcy options in Florida, you’ll often hear about Chapter 7 and Chapter 13. While both can provide debt relief, they handle secured debts like car loans very differently.

Chapter 7 Bankruptcy: Often called “liquidation bankruptcy,” Chapter 7 can discharge many types of unsecured debt (like credit card bills or medical debt). For a car loan, you typically have three main options:

- Surrender: You give the car back to the lender, and the remaining debt is discharged.

- Reaffirm: You agree to continue making payments on the original loan terms, despite filing for bankruptcy, and keep the car.

- Redeem: You pay the lender the current market value of the car in a single lump sum, freeing the car from the lien. This often requires new financing or a significant amount of cash.

Chapter 13 Bankruptcy: This is a “reorganization bankruptcy” where you propose a repayment plan, typically lasting three to five years, to repay some or all of your debts. This is where the “cramdown” feature becomes available for qualifying car loans, allowing you to modify the loan’s terms. It’s a key reason why many individuals choose Chapter 13 when they want to keep their vehicle but need to reduce their payments.

Secured vs. Unsecured Debt: Why It Matters for Your Car

To understand a cramdown, it’s crucial to grasp the difference between secured and unsecured debt.

- Secured Debt: This is debt tied to a specific asset, known as collateral. Your car loan is a prime example: the car itself serves as collateral for the loan. If you stop making payments, the lender can repossess the car.

- Unsecured Debt: This debt is not tied to any specific asset. Think credit cards, medical bills, or personal loans without collateral.

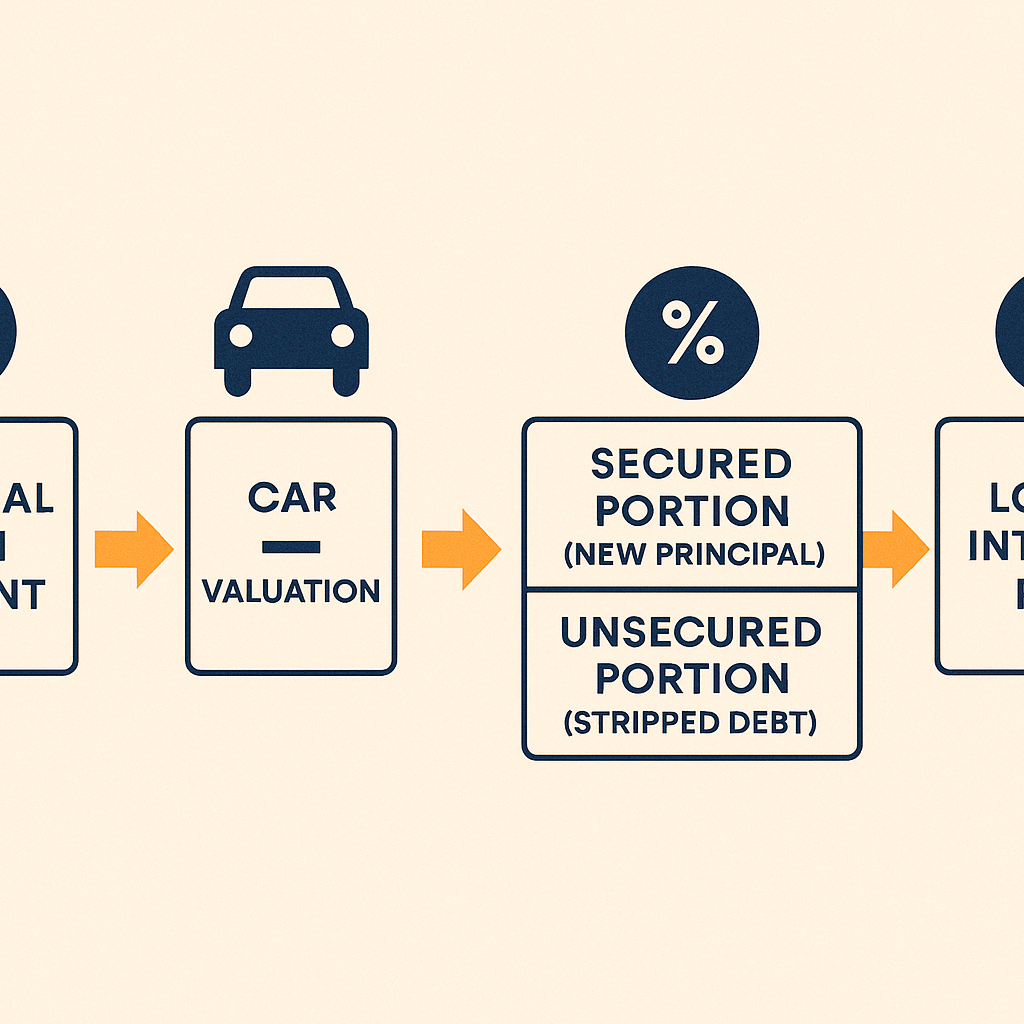

When you “cramdown” a car loan in Chapter 13, you essentially split the debt into two parts:

- The Secured Portion: This is the current market value of your car. This is the amount you will repay through your Chapter 13 plan, usually at a reduced interest rate.

- The Unsecured Portion: This is the remaining balance of your original loan that exceeds the car’s value (the “upside-down” part). This portion is treated as general unsecured debt in your bankruptcy plan and, depending on your income and assets, may be significantly reduced or completely discharged at the end of your Chapter 13 plan.

This “stripping down” of the loan is a significant advantage for those burdened by negative equity.

The “910-Day Rule”: A Key Eligibility Factor for Cramdowns

The most important factor determining whether your car loan is eligible for a cramdown in Florida is the “910-Day Rule.”

What is the 910-Day Rule?

Under federal bankruptcy law, a car loan can generally only be “crammed down” if the loan was used to purchase the vehicle and was taken out more than 910 days (approximately 2.5 years) before you file for Chapter 13 bankruptcy.

Why 910 days? Congress created this rule to protect auto lenders from immediate losses on newer vehicles. If your car loan is newer than 910 days, the lender’s claim is generally fully secured, meaning you would have to pay the full loan balance, regardless of the car’s current value, if you want to keep the car.

Common Exceptions and Nuances in Florida

The 910-day rule specifically applies to “purchase-money security interests” in cars. This means:

- Refinanced Loans: If you refinanced your car loan, even if the original loan was more than 910 days old, the refinanced loan might not be subject to the 910-day rule. This means it may be eligible for a cramdown regardless of how recently you refinanced, as it’s no longer considered a “purchase-money” loan.

- Title Loans or Loans Not Used to Purchase the Car: Similarly, if you took out a loan against your car’s title (a title loan) or used your car as collateral for a non-purchase loan, these types of loans are usually not subject to the 910-day rule and can often be crammed down, even if recently obtained.

- Cross-Collateralization: Some credit unions use “cross-collateralization” clauses, meaning a loan for one item (like a car) might be secured by other accounts or assets you have with that credit union. These can add complexity, but an experienced Florida bankruptcy attorney can help navigate how these clauses impact a cramdown.

How to Calculate the 910 Days

Counting 910 days can be tricky. It starts from the date you originally signed the loan agreement to purchase the vehicle.

This is why consulting with a legal professional who understands Florida bankruptcy nuances is crucial to determine your eligibility.

Beyond the 910-Day Rule: Other Eligibility Requirements

Even if your loan passes the 910-day test, other factors determine eligibility for a cramdown:

- The Car’s Value: You must provide a credible valuation of your vehicle. Florida bankruptcy courts often refer to recognized guides like NADA (National Automobile Dealers Association) or Kelley Blue Book. The condition of your car, mileage, and features will all influence its determined value. This is where the expertise of your attorney becomes vital to present an accurate and fair valuation to the court.

- Feasibility of Your Plan: Your proposed Chapter 13 plan, including the new car payment, must be feasible. This means you must have enough regular income to make all the payments outlined in your plan.

- Payment History: While not a strict eligibility rule, maintaining payments up until your filing can demonstrate good faith and a desire to retain the vehicle.

The Financial Impact: Lower Payments, Lower Interest

If your car loan qualifies for a cramdown, the benefits can be substantial:

- Reduced Principal Balance: Your loan balance is immediately reduced to the car’s current market value, which can be significantly less than what you originally owed, especially for older or rapidly depreciating vehicles.

- Lower Interest Rate: Florida bankruptcy courts typically set the interest rate for the crammed-down portion of the loan. This rate is usually much lower than your original contractual rate. While the precise rate varies, it often aligns with the “prime-plus” rate, which is the national prime rate plus a small percentage, reflecting a reasonable market rate for a secured loan. This can lead to significant savings over the life of your Chapter 13 plan.

- Manageable Monthly Payments: With a lower principal and interest rate, your monthly car payment inside the Chapter 13 plan will likely be much more affordable, freeing up crucial funds for other necessities or for repaying other debts in your plan.

- Path to Ownership: Once you complete your Chapter 13 plan and all required payments, the car is yours, free and clear of the original loan and its previous lender.

Example of a Potential Cramdown (Illustrative, Not Legal Advice):

Let’s say you owe $18,000 on a car with an original interest rate of 12%. The car is 3 years old (more than 910 days), and its current market value is $10,000.

- Without Cramdown: You continue paying on $18,000 at 12%.

- With Cramdown:

- Secured Portion: $10,000 (the car’s value) at a court-determined interest rate (e.g., 5-6%).

- Unsecured Portion: $8,000 (the difference between $18,000 and $10,000). This $8,000 is now treated as general unsecured debt, which means you might pay back only a small percentage of it, or even none, depending on your plan.

This dramatically reduces the amount you’re paying on the car itself and significantly lowers your overall debt burden.

The Role of Your Chapter 13 Plan

The cramdown is not an isolated event; it’s a key component of your comprehensive Chapter 13 repayment plan. Your attorney will meticulously detail how the adjusted car loan will be paid within your plan over the 3-5 year period.

The plan must be approved by the bankruptcy court, and the bankruptcy trustee will oversee its execution.

What Happens to the “Stripped” Unsecured Portion?

The part of your loan that gets “stripped away” and reclassified as unsecured debt (the $8,000 in our example above) is then lumped together with your other unsecured debts like credit cards or medical bills.

How much of this unsecured debt you repay depends on your disposable income, assets, and the specifics of your Chapter 13 plan.

In many cases, a significant portion, or even all, of this unsecured debt can be discharged at the end of your plan, offering immense relief.

Considering the Long-Term Credit Implications

Filing for any type of bankruptcy, including Chapter 13, will affect your credit score for a period. However, for those already struggling with debt and high car payments, the benefits of a cramdown and overall debt reorganization can far outweigh the temporary credit impact.

A successful Chapter 13 plan, completed with all payments made on time, demonstrates financial responsibility.

As you rebuild your credit post-bankruptcy, the reduced debt burden and newfound financial stability can put you on a stronger footing than if you continued to struggle with unmanageable payments.

Is a Car Loan Cramdown Right for You?

Deciding whether a car loan cramdown through Chapter 13 bankruptcy is the right strategy for your situation requires careful consideration of many factors.

It’s not a one-size-fits-all solution, and the rules can be complex, especially with Florida-specific court practices.

Understanding if your loan meets the 910-day rule, accurately valuing your vehicle, and crafting a feasible repayment plan are all critical steps that benefit from professional legal guidance.

An attorney experienced in Florida bankruptcy law can:

- Assess Your Eligibility: Determine if your car loan, and your overall financial situation, qualifies for a Chapter 13 cramdown.

- Accurately Value Your Vehicle: Help you present a strong case for your car’s market value to the court.

- Negotiate Interest Rates: Advise on typical interest rates approved in Florida’s bankruptcy districts (Southern, Middle, Northern) and propose a rate that the court is likely to confirm.

- Draft Your Chapter 13 Plan: Prepare a comprehensive and feasible repayment plan that includes the cramdown, ensuring it meets all legal requirements.

Represent You in Court: Navigate the bankruptcy process, including the trustee meeting and confirmation hearing, advocating for your best interests.

If you’re burdened by an upside-down car loan and are considering your options, a cramdown in Florida Chapter 13 bankruptcy could be a pathway to significantly reduce your debt and regain control of your finances.

This process allows you to keep your vehicle while making its payments affordable, providing a tangible step towards a fresh financial start.

Frequently Asked Questions About Car Loan Cramdowns in Florida Chapter 13 Bankruptcy

Q1: Can I cramdown my car loan if I refinanced it?

A1: Potentially, yes! The 910-day rule specifically applies to “purchase-money” loans (loans used to buy the car). If you refinanced your car loan, it’s generally no longer considered a “purchase-money” loan. This means it may be eligible for a cramdown regardless of how recently you refinanced. This is a common situation where a cramdown can provide significant relief.

Q2: How is my car’s value determined for a cramdown in Florida?

A2: Your car’s value is typically determined by consulting recognized industry guides like NADA (National Automobile Dealers Association) or Kelley Blue Book. The court will consider the average retail or wholesale value, taking into account your car’s mileage, condition, and specific features. Your bankruptcy attorney will work with you to present an accurate and favorable valuation to the court.

Q3: What happens to the “stripped” portion of my car loan?

A3: The amount of your car loan that exceeds the vehicle’s market value (the “stripped” or unsecured portion) is treated like your other unsecured debts, such as credit card debt or medical bills, within your Chapter 13 payment plan. Depending on your income and assets, you may pay back only a small percentage of this unsecured debt, or it could be fully discharged at the end of your successful Chapter 13 plan.

Q4: Will a cramdown hurt my credit?

A4: Filing for Chapter 13 bankruptcy will impact your credit score, as bankruptcy filings remain on your credit report for seven years. However, for many individuals already struggling with overwhelming debt and high payments, the long-term benefits of debt relief and a fresh financial start often outweigh the temporary credit impact. Completing a Chapter 13 plan successfully can demonstrate financial responsibility and help you begin to rebuild your credit over time.

Q5: Can I get a cramdown on other secured debts, like my home mortgage?

A5: No, federal bankruptcy law generally prevents “cramdowns” on a loan secured by your primary residence (your home mortgage). The rules for real estate secured by a home are significantly different from those for vehicles. However, a cramdown might be possible for other types of secured debt, like loans on investment properties or business equipment, if certain conditions are met.

Q6: What if my car is worth more than I owe?

A6: If your car’s market value is equal to or greater than your loan balance, there’s no “upside-down” portion to cramdown. In this scenario, Chapter 13 can still help you catch up on missed payments (arrears) and integrate your regular car payments into your Chapter 13 plan, potentially lowering the interest rate on the entire loan if it’s a purchase-money loan older than 910 days and the court approves a new interest rate.

Ready to Explore Your Options?

If you’re grappling with debt, especially an unmanageable car loan, understanding all your legal avenues is the first step toward regaining control. A personalized consultation can help clarify your unique situation and determine if a Chapter 13 cramdown, or another bankruptcy strategy, is the right path for you. To learn more about how Chapter 13 bankruptcy can help you achieve a fresh start, we encourage you to explore our resources on understanding Chapter 13 bankruptcy in Florida and the differences between Chapter 7 and Chapter 13. For a deeper dive into how secured and unsecured debts are handled, you can read our guide on secured vs. unsecured debt.

Taking that first step, often with a free initial consultation, can provide the clarity and confidence you need to move forward. Your financial freedom could be closer than you think.