Imagine this: You’ve made the brave decision to file for bankruptcy, feeling the weight of overwhelming debt begin to lift. You’re looking forward to a fresh financial start. Then, a few weeks later, your air conditioner—a non-negotiable in Florida—suddenly gives out. Or maybe it’s an unexpected medical bill, or your car breaks down beyond repair. You need to take on new debt, and a common question pops into your mind: “I just filed bankruptcy; does this new debt get included?”

It’s a common misconception that once you file for bankruptcy, all your financial obligations, past, present, and future, are automatically swept away. The truth is, the moment you file your bankruptcy petition is a critical line in the sand. Debts incurred before that date are handled differently than debts incurred after it. These “new” debts are called post-petition debts, and how they’re treated largely depends on which type of bankruptcy you’ve filed: Chapter 7 or Chapter 13.

Understanding this distinction is vital for anyone navigating the bankruptcy process in Florida. Getting it wrong can jeopardize your financial fresh start and lead to unexpected headaches. Let’s demystify post-petition debt together.

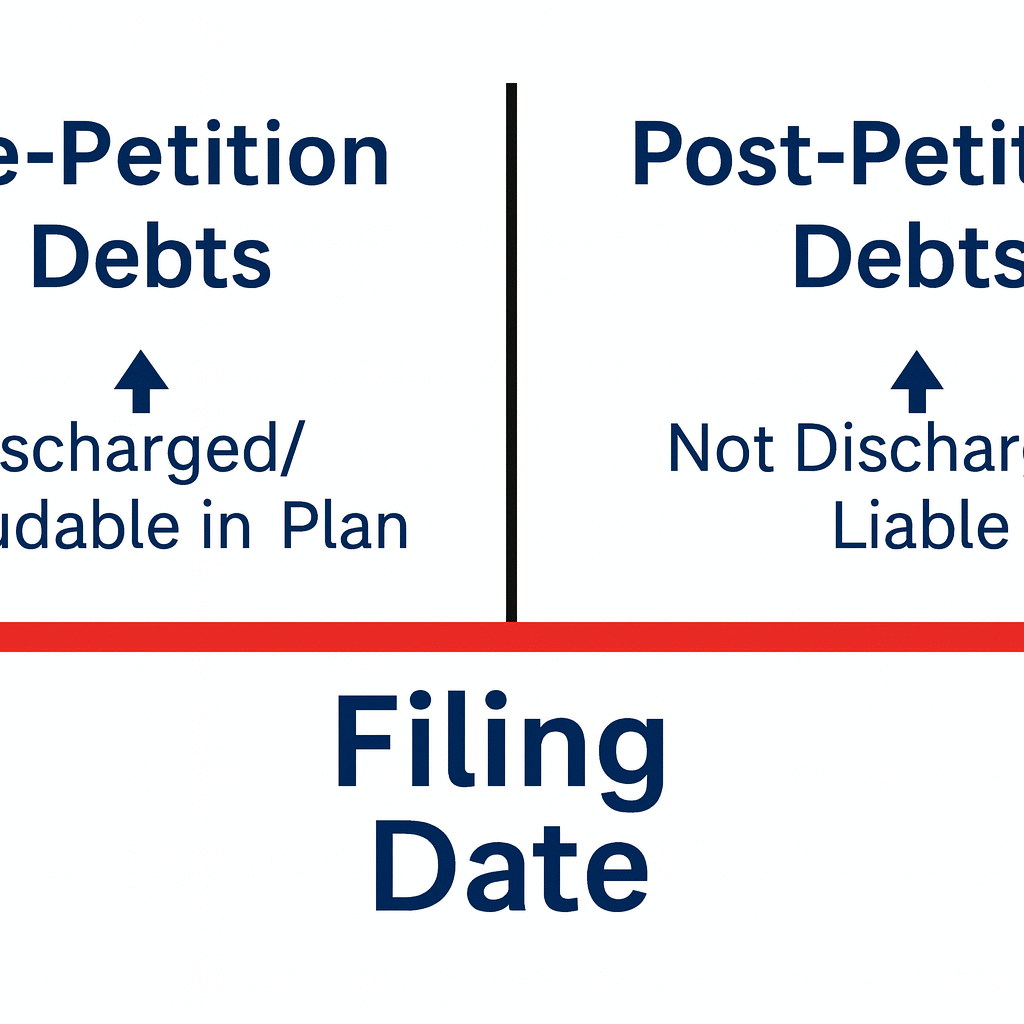

The Filing Date: Your Financial Line in the Sand

At its core, post-petition debt simply refers to any debt or financial obligation you incur after the date your bankruptcy petition is filed with the court. Think of your filing date as a financial “reset button.” Debts that existed before this button was pressed are generally considered “pre-petition debts,” and these are the ones typically eligible for discharge (or restructuring) in bankruptcy.

Any new credit card charges, a personal loan taken out, new medical bills, or even a new utility account opened after your filing date fall into the category of post-petition debt. The critical takeaway here is that the Bankruptcy Code treats these “new” debts very differently from your existing ones.

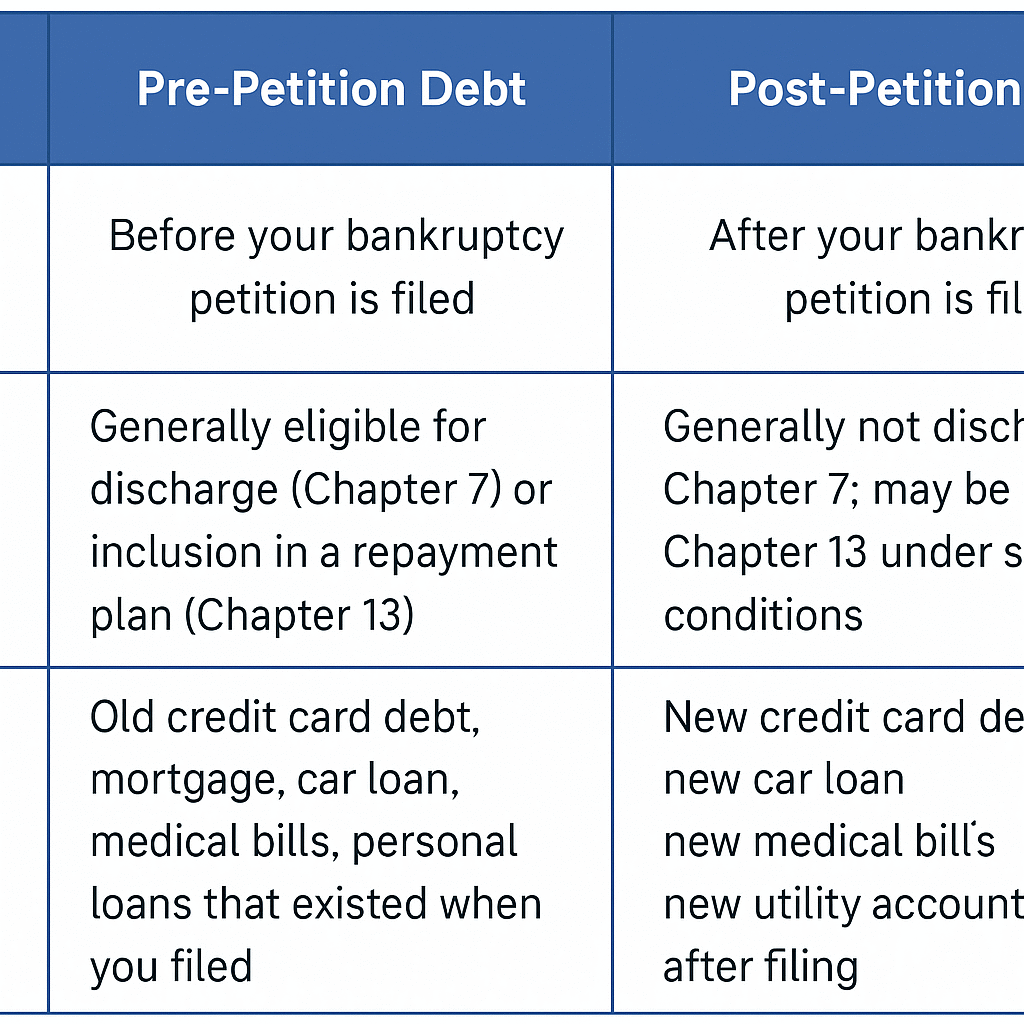

What’s the Difference Between Pre-Petition and Post-Petition Debt?

It’s easy to get these confused, especially when you’re already dealing with a lot of legal and financial terms. Here’s a simple breakdown:

Common Misconceptions About Debt During Bankruptcy

One of the biggest areas of confusion involves ongoing payments or forgotten debts:

- “I forgot to list a debt. Is it post-petition?” No. If the debt existed before you filed, it’s a pre-petition debt, even if you accidentally omitted it. In Chapter 7, most forgotten debts can still be discharged. In Chapter 13, you’d typically need to amend your plan to include it. Always inform your attorney immediately if you realize you’ve left something out!

- “I’m still paying my mortgage/car loan. Is that post-petition debt?” Not exactly. While you continue to make payments after filing, the underlying loan agreement for your house or car was a pre-petition debt. You’re choosing to “reaffirm” (in Chapter 7) or “cure arrears” (in Chapter 13) that original pre-petition debt to keep the asset. The new payments themselves aren’t post-petition debts in the sense of a new loan.

- “What about my utility bills?” Utility bills for services used before your filing date are pre-petition debts. However, if you continue to use services after filing, those new charges become post-petition debts, and you’re responsible for them. Your utility company generally cannot cut off service due to pre-petition debt, but they can require a new deposit and expect payment for post-petition service.

Post-Petition Debt in Chapter 7 Bankruptcy (Florida Focus)

Chapter 7 bankruptcy, often called “liquidation bankruptcy,” is designed to provide a relatively quick fresh start by discharging most unsecured debts. When it comes to post-petition debt in Chapter 7, the rule is quite straightforward:

General Rule: Debts incurred after your Chapter 7 petition is filed are generally not discharged. You remain personally responsible for them.

This means if you take out a new loan, charge a new credit card, or incur a new medical bill after your Chapter 7 case has been filed, those obligations belong entirely to you, separate from the debts being discharged by the bankruptcy court.

Real-World Florida Examples:

- New Car Loan: You file Chapter 7. Three months later, your old car breaks down, and you need a new one for work. If you take out a new car loan, that loan is a post-petition debt and will not be discharged in your current Chapter 7 case. You’re fully liable for it.

- Medical Emergency: You file Chapter 7. A week later, you have an unexpected medical emergency resulting in new hospital bills. These bills are post-petition debts and will remain your responsibility.

- New Credit Card Use: It’s rare to get new credit immediately after filing, but if you do and use it, those charges are post-petition and won’t be discharged.

Special Consideration: Florida HOA/Condo Assessments in Chapter 7

This is a particularly nuanced area, especially in a state like Florida, which has a high concentration of homeowners’ associations (HOAs) and condominium associations (COAs).

The Challenge: When you own property governed by an HOA or COA, you incur ongoing assessments. If you file for Chapter 7 bankruptcy, what happens to assessments that accrue after your filing date, especially if you plan to surrender the property?

Historically, there has been a “split of authority” among bankruptcy courts regarding these post-petition assessments.

- Some courts have viewed these assessments as automatically discharged along with the pre-petition debt, particularly if the debtor surrenders the property.

- However, other courts, including many in Florida, have held that assessments accruing post-petition are not discharged in Chapter 7, even if the debtor intends to surrender the property. This is because the obligation to pay arises from the ongoing ownership of the property, not just the initial purchase agreement.

What it means for Florida Debtors: If you live in an HOA or COA community and file Chapter 7, you could still be on the hook for assessments that accrue after your filing date, even if you plan to surrender the property. This is a critical point that often surprises debtors.

It underscores the importance of discussing your specific property situation with your bankruptcy attorney.

Post-Petition Debt in Chapter 13 Bankruptcy (Florida Focus)

Chapter 13 bankruptcy, often called “reorganization bankruptcy,” involves a repayment plan, typically lasting three to five years. The treatment of post-petition debt in Chapter 13 is more flexible than in Chapter 7, but also more complex.

General Rule: Like Chapter 7, debts incurred after your Chapter 13 petition is filed are generally not discharged as part of your original plan and you remain personally responsible for them.

However, unlike Chapter 7, it is possible, under specific circumstances, to add certain post-petition debts to your Chapter 13 plan or to modify your plan to account for them. This flexibility is a key differentiator.

Seeking Court Approval for New Debt in Chapter 13

Because a Chapter 13 plan is a commitment to repay creditors over several years, the court wants to ensure that any new debt doesn’t jeopardize your ability to complete your plan. Therefore, if you need to incur significant new debt (like a car loan or large medical expenses) while in Chapter 13, you often need court approval before taking on the obligation

When and Why It’s Needed: If the new debt is substantial or could impact your ability to make plan payments, you’ll need to file a motion with the bankruptcy court, often through your attorney. The court will evaluate:

- Necessity: Is the new debt truly necessary (e.g., essential vehicle for work, emergency medical care) or is it a luxury?

- Feasibility: Can you afford the new debt and still make your Chapter 13 plan payments?

- Impact on Creditors: Will the new debt unfairly prejudice your existing creditors under the plan?

Florida-Specific Court Processes: While the general rules are federal, the specific procedures for filing motions for new debt can vary slightly by judicial district in Florida. Your attorney will be familiar with the local rules and what judges in your district typically look for.

Risks of Not Getting Approval: Incurring significant new debt without court approval in Chapter 13 can have serious consequences, including:

- The court could dismiss your case, leaving you responsible for all pre-petition and post-petition debts.

- Creditors of the new debt could sue you, as their claim isn’t protected by the bankruptcy.

- It could complicate your ability to receive a discharge at the end of your plan.

Real-World Florida Examples:

- New Car in Chapter 13: Your vehicle breaks down during your Chapter 13 plan. You need reliable transportation for work. Your attorney can file a motion with the court to approve a new car loan. The court will review your income, expenses, and the necessity of the vehicle.

- Significant Medical Expenses: A sudden illness leads to major bills. You may be able to modify your Chapter 13 plan to include these new medical debts, or at least discuss how to manage them with your trustee and attorney.

- Unforeseen Home Repairs: If your roof is damaged during a Florida hurricane or severe storm, and insurance doesn’t cover everything, you might need a loan for repairs. Your attorney can help you seek approval.

Special Consideration: Florida HOA/Condo Assessments in Chapter 13

Unlike Chapter 7, assessments that accrue post-petition in Chapter 13 are generally considered post-petition debts and must be paid as they come due. However, if you are keeping your property, these ongoing assessments are typically built into your monthly budget, and your plan must demonstrate that you have sufficient income to pay them.

If a significant amount of post-petition HOA/COA debt accrues, you might be able to modify your Chapter 13 plan to pay it through the plan, especially if it helps cure an arrearage that could lead to foreclosure. This is another area where experienced legal guidance is crucial.

The “Murky Problem” of Enforcing Post-Petition Consumer Debt in Chapter 13

While typically you need court approval for new significant debt in Chapter 13, some smaller, ordinary course of business debts (like monthly utility bills or minor medical co-pays) are often paid directly by the debtor outside the plan.

However, there can be “murky problems” if a debtor incurs substantial new consumer debt without approval. While technically the creditor of this new debt isn’t bound by the bankruptcy, the debtor’s commitment to the Chapter 13 plan is paramount. A trustee might view significant unauthorized new debt as a sign of bad faith or an inability to complete the plan, leading to potential issues with discharge or even dismissal of the case. It’s always best to be transparent with your attorney about any new financial obligations.

Mastering Your Financial Journey: Strategies and Next Steps

Navigating post-petition debt requires careful planning and open communication with your legal team. Here are some strategies and insights to help you manage your financial future while in bankruptcy:

Strategies for Managing Post-Petition Needs

- Budgeting is Key: Even after filing, maintain a meticulous budget. Understand your income and expenses, and try to build an emergency fund, even a small one, to cover unexpected needs without incurring new debt.

- Communicate with Your Attorney: This is the most crucial piece of advice. Before taking on any new debt, no matter how small you think it is, talk to your Florida bankruptcy attorney. They can advise you on the best course of action, whether it’s seeking court approval, paying it outside the plan, or exploring other options. Transparency prevents problems.

- Prioritize Necessities: Focus on essential needs like housing, transportation for work, and medical care. Avoid non-essential purchases or luxury debts while your bankruptcy case is ongoing.

Impact on Your Credit Beyond Discharge

While bankruptcy provides a path to discharge pre-petition debts, incurring significant post-petition debt, especially if it leads to default, can negatively impact your credit score after bankruptcy. Rebuilding credit after bankruptcy is a marathon, not a sprint. Taking on new, unmanageable debt post-petition can set back your progress toward a healthier financial future.

To learn more about rebuilding your credit and managing your finances effectively after filing, explore our resources on bankruptcy law in Florida.

Conversion Considerations

Sometimes, a debtor might convert from Chapter 13 to Chapter 7 (or vice versa). How does this affect post-petition debt?

- Chapter 13 to Chapter 7: If you convert from Chapter 13 to Chapter 7, any debts incurred after your initial Chapter 13 filing date (but before the conversion to Chapter 7) are generally not discharged in the Chapter 7 case. This is a critical point and reinforces why careful planning in Chapter 13 is so important.

Chapter 7 to Chapter 13: If you convert from Chapter 7 to Chapter 13, pre-petition debts from the original Chapter 7 filing become part of the Chapter 13 plan. Debts incurred after the initial Chapter 7 filing (but before the Chapter 13 conversion) would generally be treated as post-petition debts in the new Chapter 13 case and would need to be addressed under Chapter 13 rules, potentially requiring modification or separate payment

Frequently Asked Questions About Post-Petition Debt in Florida Bankruptcy

What is the primary difference between how Chapter 7 and Chapter 13 treat post-petition debt?

In Chapter 7, post-petition debts are generally not discharged, meaning you remain fully responsible for them. In Chapter 13, post-petition debts are also generally not discharged, but certain essential new debts can potentially be included in your repayment plan or allowed by the court, often with court approval, allowing for more flexibility.

Can I get a new car loan after filing for Chapter 13 in Florida?

Yes, but you will almost certainly need to seek court approval. Your attorney will file a motion explaining why the new vehicle is necessary and how you can afford the payments without jeopardizing your existing Chapter 13 plan.

What happens if I have a medical emergency after filing bankruptcy?

Medical bills incurred after your filing date are post-petition debts. In Chapter 7, you’ll be responsible for them. In Chapter 13, if the amount is substantial, you might be able to modify your plan to address it, or your attorney can advise on direct payment strategies. Always discuss this with your attorney immediately.

Are HOA or condo assessments incurred after filing bankruptcy discharged in Florida?

This is a complex area, especially in Florida. In Chapter 7, there’s a split of authority, but many Florida courts hold that post-petition assessments are not discharged, even if you surrender the property. In Chapter 13, these are considered post-petition debts, and you typically need to pay them as they accrue, especially if you intend to keep the property. Always consult your attorney about your specific property and association.

Can I use a credit card after filing bankruptcy?

Technically, yes, if you manage to obtain one. However, any charges made on a new credit card after your filing date are post-petition debts and will not be discharged in your current bankruptcy case. In Chapter 13, taking on new credit without court approval can put your plan at risk. It’s generally advisable to avoid new credit until your bankruptcy is fully discharged and you’ve established a plan for rebuilding your credit.

What if I forgot to list a debt in my bankruptcy petition? Is it considered post-petition?

No, if the debt existed before you filed your petition, it is a pre-petition debt, even if you inadvertently omitted it. You should immediately inform your bankruptcy attorney so they can advise you on amending your schedules or other appropriate actions.

How does the automatic stay interact with post-petition debts in Florida?

The automatic stay generally only applies to pre-petition debts, stopping collection actions for those. It typically does not prevent creditors from collecting on debts you incur after your bankruptcy filing, as these are post-petition obligations.

Can I convert my bankruptcy case if I incur large post-petition debts?

Converting from Chapter 13 to Chapter 7 might be possible if your financial situation changes dramatically, but it won’t typically discharge significant post-petition debts. Conversion has its own rules and implications, and it’s a decision that must be made with careful legal advice from your attorney.

What are the risks of paying new debt outside the Chapter 13 plan?

For small, ordinary course expenses (like monthly utilities), paying outside the plan is common. However, for larger debts, paying outside the plan without court approval could be seen by the trustee as a sign that you cannot afford your plan payments or that you are prioritizing a new creditor over existing ones, potentially leading to dismissal of your case.

How can I proactively plan for potential post-petition needs while in bankruptcy in Florida?

The best way is to work closely with your Florida bankruptcy attorney before and during your case. Discuss your budgeting, emergency planning, and any foreseeable large expenses. Having an open dialogue and understanding the rules will help you avoid missteps.

Your Path to a True Fresh Start

Understanding the difference between pre-petition and post-petition debt is a crucial step in truly achieving a fresh start after bankruptcy. While the rules can seem complex, especially with Florida-specific nuances like HOA assessments, you don’t have to navigate them alone.

At Gort Law P.A., we believe in empowering our clients with knowledge and personalized guidance. Attorney Michael A. Gort, with his extensive legal and business background, provides the comprehensive advice needed to help individuals and businesses make informed decisions about their financial future.

If you’re considering bankruptcy, or if you’ve already filed and have questions about new debts, reach out for a confidential, no-cost consultation. We offer virtual consultations for your convenience and transparent pricing with no hidden fees. Your journey to financial stability deserves clear, compassionate, and experienced legal support.