Life throws unexpected curveballs—medical emergencies, job loss, or business setbacks. When debt spirals out of control, it’s easy to feel trapped. In Florida, an increasing number of individuals are seeking relief through bankruptcy. In 2023, approximately 29,410 total bankruptcy filings were recorded in Florida, with that number rising to 37,156 in 2024. Nationally, individual filings saw a 16% year-over-year increase in June 2025, highlighting a growing need for clear, compassionate legal guidance (thebankruptcylawfirm.net, abi.org).

Considering Chapter 7 bankruptcy means you’re looking for a powerful tool to discharge most unsecured debts and regain financial footing. But before you can file, you must meet specific federal and state requirements.

Is Chapter 7 Bankruptcy Right for You in Florida?

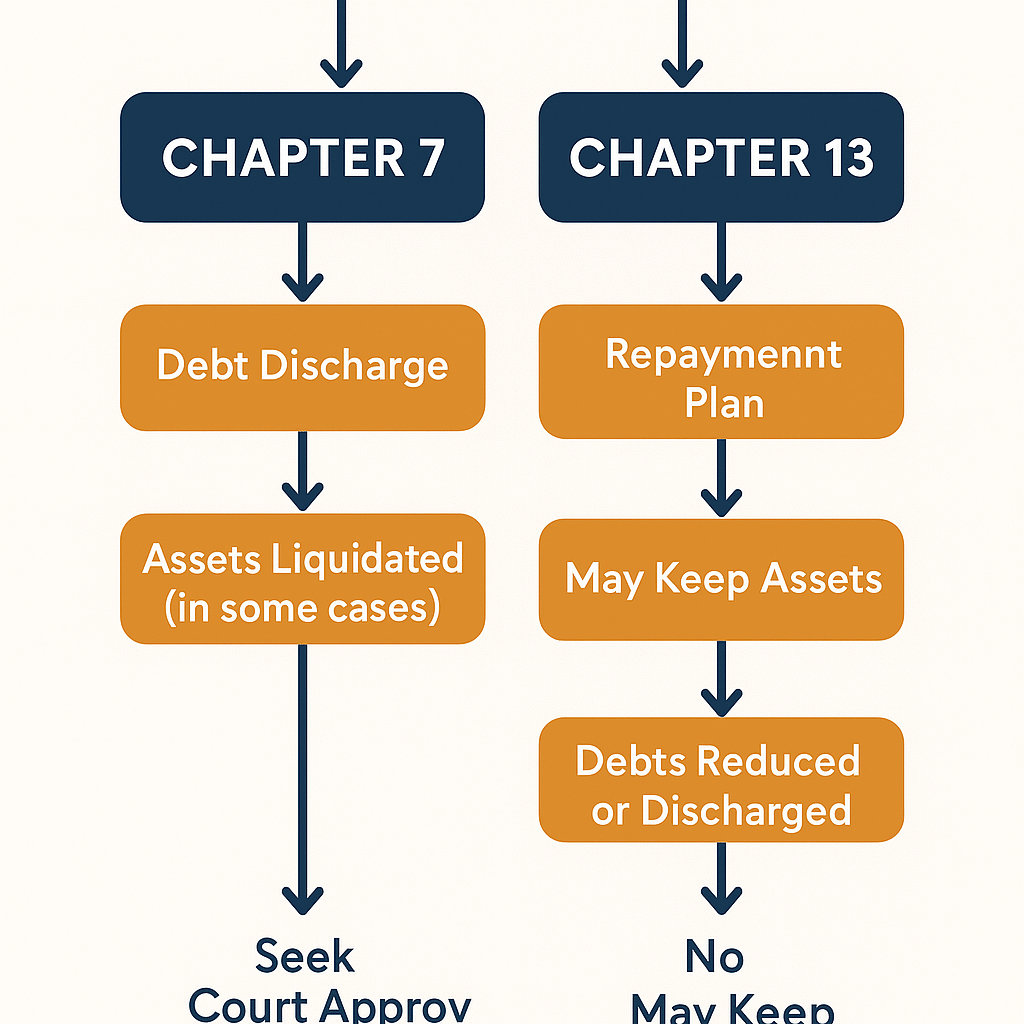

Chapter 7 bankruptcy, often called “liquidation bankruptcy,” allows you to eliminate most unsecured debts like credit card balances, medical bills, and personal loans. The core idea is to give you a “fresh start.” In exchange, a bankruptcy trustee may liquidate certain non-exempt assets to repay creditors, though it’s important to remember that over 90% of Chapter 7 cases are “no-asset” cases, meaning debtors don’t lose property due to exemptions.

While Chapter 7 offers significant relief, it’s not for everyone. Its counterpart, Chapter 13 bankruptcy, involves a repayment plan over three to five years and is often suitable for individuals with a regular income who don’t qualify for Chapter 7 or want to save their home from foreclosure.

Understanding the differences is crucial for making the right choice.

Step 1: Passing the Florida Chapter 7 Means Test

The primary hurdle for Chapter 7 eligibility is the “Means Test.” Enacted as part of the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) of 2005, this test ensures that individuals with the ability to repay their debts do so through Chapter 13, rather than discharging them entirely under Chapter 7. It’s a two-part assessment:

Part A: The Median Income Test

First, your household’s “current monthly income” (CMI) is compared to the median income for a household of the same size in Florida.

Your CMI is generally your average gross income over the six full calendar months leading up to your bankruptcy filing.

Crucially, these median income figures are updated periodically by the U.S. Trustee Program (part of the Department of Justice) based on U.S. Census Bureau data.

It’s vital to use the absolute latest official numbers. While we provide an example, always check the official U.S. Trustee Program website for the most current data for Florida.

As of April 2024, the Florida median income thresholds were (lrlawoffice.com, justice.gov, perplexity.ai):

- 1-Person Household: $62,973

- 2-Person Household: $77,639

- 3-Person Household: $89,908

- 4-Person Household: $104,069

- (Add $9,900 for each additional person above 4)

If your household’s CMI is below the Florida median for your household size, you generally pass the Means Test and are presumed eligible for Chapter 7. This is often referred to as being “below median.”

Part B: The Disposable Income Test (for Above-Median Earners)

If your CMI is above the Florida median, you move to the second part of the Means Test: the disposable income test.

This more complex calculation involves subtracting certain allowable expenses from your CMI.

These expenses are based on IRS National and Local Standards, as well as actual necessary expenses, such as:

- Taxes (federal, state, and local)

- Mandatory payroll deductions

- Health insurance, disability insurance, and health savings account contributions

- Life insurance premiums (term life for the debtor or dependents)

- Court-ordered payments (e.g., child support, alimony)

- Childcare expenses

- Home energy costs and utilities

- Food, clothing, and other necessities (based on IRS standards)

- Secured debt payments (e.g., mortgage, car loans)

If, after subtracting these allowable expenses, your “disposable income” (what’s left over) is below a certain threshold, you may still qualify for Chapter 7.

If it’s too high, the court may determine that you have sufficient income to repay some of your debts, pushing you towards Chapter 13 instead.

Important Means Test Exceptions

It’s worth noting that certain individuals are exempt from the Means Test entirely:

- Business Debt Exception: If the majority of your debt (more than 50%) is business-related rather than consumer debt, you are generally not required to pass the Means Test. This is particularly relevant for entrepreneurs and small business owners.

- Veteran Debt Exception: Disabled veterans whose debt primarily arises from military service are also exempt from the Means Test.

- Certain other non-consumer debt: Debt that is not incurred primarily for personal, family, or household purposes can also lead to an exemption.

Understanding these exceptions can be critical, and an experienced attorney can help determine if one applies to your situation.

Step 2: Fulfilling Mandatory Pre-Filing Requirements

Passing the Means Test is just one part of the eligibility puzzle. Before you can officially file, the bankruptcy code requires two crucial pre-filing steps:

Credit Counseling Course

You are mandated to complete an approved credit counseling course within 180 days (approximately six months) before you file your bankruptcy petition. This course, usually one hour long, aims to educate you on managing money and exploring alternatives to bankruptcy. You’ll receive a certificate of completion, which must be filed with your bankruptcy petition.

You can find a list of approved agencies for Florida residents through the U.S. Department of Justice website. For specific guidance on finding and selecting these providers, see our resource on.

Gathering Essential Documentation

Accuracy and completeness are paramount in bankruptcy filings. You’ll need to provide a vast array of financial documents and information. Starting this process early will save you significant stress and ensure your petition is submitted correctly.

Here’s a comprehensive checklist of documents and information you’ll need to gather:

- Proof of Income:

- Pay stubs (last 60 days)

- Proof of other income (social security, disability, unemployment, retirement, alimony, child support, rental income)

- Tax returns (last two years, and possibly year-to-date income statements)

- Detailed Debt Information:

- Statements for all secured debts (mortgages, car loans)

- Statements for all unsecured debts (credit cards, medical bills, personal loans, student loans)

- Collection notices and judgments

- Asset Information:

- Property deeds (home, land)

- Vehicle titles and registration

- Bank statements (all accounts, last 6-12 months)

- Retirement account statements (401k, IRA, pension)

- Investment account statements (stocks, bonds, mutual funds)

- Life insurance policies

- Information on other valuable assets (jewelry, art, collections, business interests)

- Monthly Living Expenses:

- Utility bills

- Food and clothing expenses

- Transportation costs

- Medical expenses

- Insurance premiums

- Childcare costs

- Other regular household expenses

- Past Financial Transactions:

- Information on any property transferred or sold in the past 2-4 years

- Records of large payments made to creditors or family members in the past year

- Details of any lawsuits or legal actions you’re involved in

This meticulous collection of data forms the backbone of your bankruptcy petition. Any discrepancies or omissions can lead to delays or even dismissal of your case.

Step 3: Protecting Your Assets with Florida Exemptions

A common fear when considering Chapter 7 is losing everything. However, federal and Florida state laws provide “exemptions” that allow you to protect certain property from being sold by the bankruptcy trustee.

Florida has particularly generous exemptions, especially regarding your home. Over 90% of Chapter 7 cases are “no-asset” cases, meaning debtors lose no property (hoskinsandturco.com).

Key Florida Exemptions to Know:

- Homestead Exemption: Florida’s most powerful exemption. If you live in Florida and own a home, it’s generally protected from creditors, regardless of its value, provided it’s under half an acre in a municipality or 160 acres elsewhere, and you’ve owned it for at least 1,215 days (approximately 3 years and 4 months). This exemption is why many people facing financial hardship consider Florida for its debtor-friendly laws.

- Personal Property Exemption: You can protect up to $1,000 in personal property (e.g., furniture, electronics, clothing).

- Wildcard Exemption: If you don’t use the full homestead exemption, you might be able to use a “wildcard” exemption of up to $4,000 for any personal property. This is particularly useful for those who rent or have limited equity in their home.

- Motor Vehicle Exemption: This is a crucial recent update! As of July 1, 2024 (SB 158), Florida’s motor vehicle exemption dramatically increased from $1,000 to $5,000 (nacba.org, theprestonlawfirm.com). This means you can protect up to $5,000 in equity in one vehicle.

- Wage Exemption: Your wages or earnings are protected if you are considered the “head of a family” (providing more than half the support for a dependent).

- Retirement Accounts: Most qualified retirement accounts (e.g., 401(k)s, IRAs, pensions) are fully protected.

Understanding how these exemptions apply to your specific assets is critical for maximizing what you keep and minimizing your perceived risk.

Common Misconceptions & What NOT to Do Before Filing

The decision to file for bankruptcy is often shrouded in myths. Let’s debunk some common misconceptions and highlight critical pitfalls to avoid before you file:

- Myth: High income automatically disqualifies you.

- Reality: As discussed with the Means Test, above-median income earners can still qualify based on allowable expenses.

- Myth: You lose everything you own.

- Reality: Florida’s generous exemptions protect most essential assets, as evidenced by the high percentage of “no-asset” cases.

- Myth: You can choose which debts to include.

- Reality: You must list all your debts and creditors in your bankruptcy petition. Concealing debts can lead to serious consequences.

- Myth: You can only file for bankruptcy once.

- Reality: You can file for Chapter 7 multiple times, but there are waiting periods between filings (e.g., 8 years between Chapter 7 discharges).

What NOT to Do Before Filing (Critical Red Flags):

Avoiding these common mistakes is paramount to a smooth bankruptcy process

- Transferring Assets: Do not transfer property (e.g., putting your house in your child’s name) to friends or family members to avoid it being seized by the bankruptcy court. This is considered a fraudulent transfer and can lead to severe penalties, including dismissal of your case or even criminal charges. The court will look back several years (the “look-back period”) for such transfers.

- Running Up Debt: Do not use credit cards or take out new loans shortly before filing with no intention of repaying them. This can be deemed fraudulent and lead to certain debts being non-dischargeable.

- Paying Back Family or Friends: While well-intentioned, paying back certain creditors (especially family members) significantly more than other creditors in the 90 days (or one year for insiders) before filing is considered a “preferential payment.” The trustee can recover these funds from the person you paid.

- Hiding Assets or Income: Full and honest disclosure is required. Any attempt to conceal assets, income, or debts will be discovered and can result in the denial of your discharge or criminal prosecution.

Your honesty and full disclosure are fundamental to a successful bankruptcy outcome.

Why Expert Legal Guidance is Indispensable in Florida Bankruptcy

While some individuals attempt to file bankruptcy on their own, the process is incredibly complex, filled with intricate legal requirements, strict deadlines, and potential pitfalls.

Florida’s specific laws, coupled with federal bankruptcy code, create a landscape that’s challenging to navigate without expert assistance.

An experienced Florida bankruptcy attorney provides invaluable support by:

- Accurately Assessing Eligibility: They can precisely calculate your Means Test, identify applicable exceptions, and advise on whether Chapter 7 or Chapter 13 is your best option.

- Maximizing Exemptions: A skilled attorney ensures you claim all available exemptions, protecting as many of your assets as legally possible.

- Preparing Flawless Documentation: They gather and prepare all required forms and schedules, ensuring accuracy and completeness, which is critical for preventing delays or dismissal.

- Navigating the Trustee Meeting: They prepare you for and accompany you to the meeting of creditors (the “341 meeting”), where you’ll answer questions from the bankruptcy trustee.

- Handling Unforeseen Issues: If creditors object to your discharge or other complications arise, your attorney acts as your advocate, protecting your rights.

At Gort Law P.A., Attorney Michael A. Gort brings a unique blend of extensive legal knowledge and real-world business experience to your case.

This dual perspective ensures comprehensive legal solutions tailored to your unique financial situation, providing the authoritative guidance you need at this critical juncture.

Your Next Steps Towards Financial Freedom

Deciding to pursue bankruptcy is a significant step toward regaining control of your financial future. Given the complexity and importance of the process, acting proactively and seeking expert advice early is the best course of action.

Don’t let the weight of debt or the intricacies of the law deter you from exploring your options.

A free initial consultation with a qualified Florida bankruptcy attorney can provide the clarity and confidence you need to move forward.

Contact Gort Law P.A. today for a confidential, no-obligation consultation. Let us help you understand your eligibility, prepare meticulously, and guide you towards the fresh financial start you deserve.

Frequently Asked Questions (FAQs)

How long does the Chapter 7 bankruptcy process usually take in Florida?

The typical Chapter 7 bankruptcy case in Florida takes approximately 3 to 6 months from the filing date to discharge. This timeframe can vary based on the complexity of your case, the volume of cases in your specific court district, and any unforeseen issues that may arise.

Can I file for bankruptcy more than once in Florida?

Yes, you can file for bankruptcy more than once. However, there are waiting periods between discharges. For Chapter 7, you generally must wait 8 years from the filing date of a previous Chapter 7 case to receive another Chapter 7 discharge. If you previously filed Chapter 13, you might be able to file Chapter 7 sooner, typically after 6 years from the Chapter 13 filing date, provided you paid back a certain percentage of your unsecured debts.

What happens if I don’t qualify for Chapter 7 bankruptcy?

If you don’t qualify for Chapter 7 (typically because you fail the Means Test), you may still be eligible for Chapter 13 bankruptcy. Chapter 13 involves a court-approved repayment plan where you make regular payments to a trustee over 3 to 5 years, allowing you to catch up on arrears, protect assets, and restructure debts. An attorney can help you determine if Chapter 13 is a viable alternative.

Are student loans dischargeable in Florida bankruptcy?

Student loans are notoriously difficult to discharge in bankruptcy. To discharge them, you must prove “undue hardship,” which is a very high legal standard that few debtors meet. This generally requires a separate lawsuit within the bankruptcy, demonstrating that repayment would prevent you from maintaining a minimal standard of living, that your financial condition is unlikely to improve, and that you’ve made a good-faith effort to repay the loans.

What about Florida’s residency requirements for bankruptcy filing?

To file bankruptcy in Florida, you must reside in the state, or have your domicile, your principal place of business, or your principal assets in Florida for the greater part of the 180-day period immediately preceding your filing. This generally means you need to have lived in Florida for at least 91 days before filing. For more detailed information on this, refer to our guide on

Navigating financial challenges can feel like walking through a dense fog, especially when considering a solution as significant as bankruptcy. For many individuals in Florida facing overwhelming debt, Chapter 7 bankruptcy offers a genuine path to a fresh start. But how do you know if you qualify? And what critical steps must you take before filing?

At Gort Law P.A., we understand that you’re not just looking for information; you’re seeking clarity, confidence, and a trusted guide through what can seem like a daunting legal process. Our goal is to empower you with precise, actionable insights, drawing on extensive legal and business experience to help you make informed decisions.

This guide will demystify the eligibility criteria and essential pre-filing requirements for Chapter 7 bankruptcy in Florida, ensuring you’re fully prepared for what comes next.